Qualified Charitable Distributions in 3 Bullets

By: Allison Schmidt, Financial Advisor, CFP®, CPA

As a part of our financial planning process, we began implementing MyStrategy TAX a couple years ago. This is where we review your tax returns each year and look for opportunities that may be hiding out. Opportunities such as Roth conversions, Donor Advised Funds, loss carry-forwards, and one of my recent favorites, Qualified Charitable Distributions.

Qualified Charitable Distributions (“QCD”) are an otherwise taxable distribution from an IRA owned by an individual who is age 70½ or over that is paid directly from the IRA to a qualified charity*. QCDs provide a fairly straightforward strategy that can make a big difference, but not many people seem to know much about it.

1. Who does it help?

The perfect candidate for a QCD is someone who is at least 70½ , takes the standard deduction, and is on the edge of an increase to their Medicare base premium due to income thresholds.

(Anyone on Medicare pays a base premium each month, however if you make over a certain amount those premiums increase. The income limit is based on adjusted gross income plus tax-exempt interest.)

2. How does it work?

You simply donate to your favorite 501c3 organization directly from your Traditional IRA, or in a real-life application, we work with you to put together an annual giving plan to set up the check distributions to the charities you support. Yes, that’s all it takes.

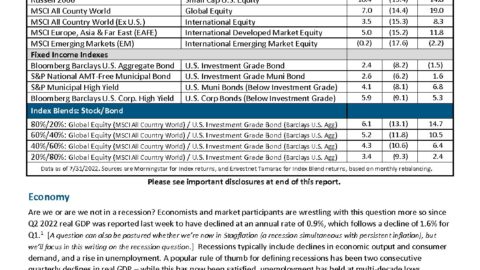

Most of the time people write checks from their checking account to the charity, which requires someone to itemize their deductions in order to get the tax benefit for the contribution; however, by giving directly from your IRA, your taxable distribution is reduced. Essentially this allows you to get both the income deduction from the contribution and the standard deduction. Sounds fairly confusing, but don’t stop here, I think an example helps, see the chart below!

Here’s an example to show how it could all shake out in terms of dollars. We look at the same income breakdown with someone utilizing the standard deduction. The only difference is that the charitable donation, being a QCD, comes from the IRA, essentially making the contribution an “above the line deduction”, as opposed to donating $10k from their checking account.

The savings is $6,744 from simply utilizing a QCD to make the donation, which allowed this couple to avoid $181 in additional monthly Medicare premiums per person because their AGI exceeded the $222k income threshold (cost of $4,344 per year) and the ability to reduce income by $10k (which would have been taxed at 24% or an additional $2,400).

3. What’s the bottom line?

It takes a bit of math to work through the reasons for utilizing a QCD, but in the end, there are certainly ideal scenarios where a Qualified Charitable Distribution can be really beneficial. For such an easy strategy to implement, we think it’s worth considering if you’re over 70.5.

*irs.gov

Securities offered through LPL Financial, Member FINRA/SIPC. Investment advice offered through HD Wealth Strategies, a registered investment advisor and separate entity from LPL Financial. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.