The Great Recovery Continues and Higgins & Schmidt Rebalances

Q1 2021: The American re-opening balances vaccine hopes, more stimulus, inflation fears, rising rates, and a hard charging stock market.

By: Steven Higgins, Financial Advisor, Partner

The nation was collectively ready to put 2020 in the rear view mirror. As much as we all want to forget and move on, we know that the issues that caused the depressing environment of the previous year are still ever present. As more and more people are vaccinated and hopes of the pandemic ending soon are growing, we see the emergence of what will likely be a different type of aftermath as we pick up the pieces. Over the last year, the combined stimulus efforts of the Federal Government and the the Federal Reserve amount to over $10 trillion dollars. Available “cash like” instruments such as savings accounts, checking accounts, CDs, and money markets (also known as “M2” or “near cash”) have increased from around $16 trillion a year ago to about $21 trillion today. Last week, JP Morgan Chase CEO Jaimie Dimon noted that Americans have $2 trillion dollars more in just their checking accounts than they did last year. The stock pile of cash represents the result of stimulus programs that sent money directly to most Americans and increased savings from a lack of spending opportunities such as travel, eating out, gas, etc. over the last year. There is really no doubt that this national war chest of cash is poised to flood the streets as America continues to re-open.

Stocks have reacted positively to the environment as companies continue to post strong earnings reports outpacing most expectations. As a result, the S&P 500 started the year with gains to date of over 10%, adding to the total return of the S&P 500 for 2020 of over 18%. Astonishingly, the S&P 500 has now gained 25% since the pre-pandemic high of February 19, 2020 and the pandemic isn’t over yet.

As part of the investment process at Higgins & Schmidt Wealth Strategies we use a tactical rebalancing and repositioning system that works to keep our clients’ investment portfolios in strategic investment allocations during periods of both positive and negative volatility. In market corrections and pullbacks we actively add money to stocks. For example, during last March’s COVID inspired stock market crash, we made 3 separate tactical repositions into stocks. Those additions have significantly benefited from the massive gains in stocks over the past year. As the gains continue, our process directs us to rebalance our client’s portfolios to keep from overweighting in stocks which could cause an unintended increase to risk exposure and ultimately compromise our clients’ ability to meet their long term goals. In the last week of 2020, we rebalanced our client’s portfolios, and over the last two weeks we have completed another rebalance as the the stock market has continued to post gains. As the year continues to unfold we are expectant and prepared for the re-emergence of some negative volatility, and we’ll certainly be ready to put our process into action.

The 5 most relevant topics driving the markets and our investment related conversations with clients today:

Vaccine Success:

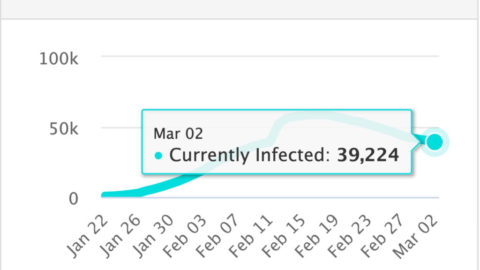

As of this post, over 40% of all Americans have received at least one dose of the vaccine. More importantly, over 80% of people over 65 years old have received at least one dose of the vaccine. People over the age of 65 account for 80% of all COVID related deaths.*

Inflation:

The Consumer Price Index, a standard inflation gauge, rose 2.6% over the last year compared to 1.5% over the previous 12 month period. The prices for raw materials are rising at the fastest pace indicating a massive production demand. For example, the price of lumber, depending on the type of wood, has increased 200-300% over the last year. That increase alone is accounting for a $9,000 increase to the average cost to build a new home. Pent up demand and available cash are poised to not only maintain the the higher inflation rate but possibly increase it.**

Real Estate Prices:

The Case-Shiller Composite 20 Home Price Index blends the 20 largest real estate markets in America. Over the last three years the index has increased by 16.57% and 9.64% of that has come in the last year alone, showing that increasing demand and dwindling supply continued to force prices higher. **

Interest Rates:

The Ten Year Treasury rate has increased from 0.58% to 1.58% over the last year in a reaction to increased money supply and anticipation of inflation as investors sell bonds. The Barclays Aggregate US Bond Index is flat over the last 12 months and we anticipate the bond portions of portfolios to struggle for any gains in this environment. The 30 year mortgage rate is at 3.13% year-to-date, up from 2.67%.**

*covid.cdc.gov

**Ycharts.com

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful. Rebalancing a portfolio may cause investors to incur tax liabilities and/or transaction costs and does not assure a profit or protect against a loss. Stock investing involves risk including loss of principal. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.