Coronavirus Update & Virtual Meeting Replay

By: Steven Higgins, Financial Advisor, Principal

& Allie Schmidt, Financial Advisor, CFP®, CPA

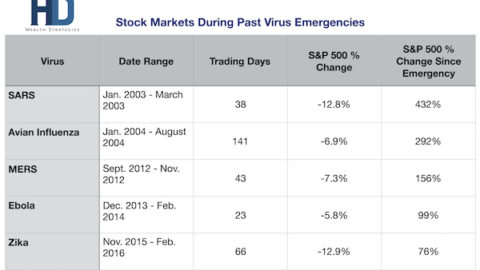

On Friday February 28th We held a virtual client meeting to discuss the market’s spirited reaction to the Coronavirus. The large number of people who attended the meeting was evidence of people’s interest and concern about this issue. We certainly want to emphasize the respect of the human toll of the disease while also helping our clients stay focused on goals and strategies. We have posted a replay of the virtual meeting here on our blog. Additionally, here are some updated figures since the meeting last Friday.

Markets Remain Unsettled

Markets remain volatile, however, there has been some resiliency with Monday’s gains of 5% in the Dow Industrial Average being the largest single point gain in the history of the index.

Fed Steps In

It was fully expected that in response to a possible economic slow down, the Federal Reserve Board would cut the benchmark rate at the Board’s upcoming March meeting. On Tuesday, The Fed Board preempted their meeting and cut the rate by one half percent.

Active Cases Continue to Decline

Media reports the continued spread of the Coronavirus. It is important to note that while the Coronavirus is being found in more countries, the total number of active cases (those that can spread the virus) is down 33% from the high on February 16, 2020. The reason being that people are recovering from the disease at faster rates than new cases are being discovered. Of the 92,870 total reported cases, 48,469 have recovered.

As we mentioned in our virtual client meeting, there is no way to know when the virus will run its course or otherwise be contained, nor can we know when the economic and market reactions will subside. We do know that as part of our process, we have developed strategies and plans for our clients to deal with normal instances of market volatility like this one. The key is having a plan and strategy before things happen.

We have also included a graphic that was shared with us by First Trust Portfolios illustrating each of the market volatility events and obstacles since 2008. Each of these moments, at the time, seemed different and some provoked fear. Nevertheless, as has been the case every single time in history, the prepared and patient investor has won. This is a great chart to share with others and is certainly to be a conversation starter.

Securities offered through LPL Financial, Member FINRA/SIPC. Investment Advice offered through HD Wealth Strategies, a registered investment advisor and separate entity from LPL Financial.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.