Income Series

Part One: 3 benefits to higher interest rates

Written By: Allison Schmidt, Financial Advisor, CFP®, CPA

There are pros and cons to all things. Having lived most of my adult life in a historically low interest rate environment, I was used to the benefits. The largest of which being cheap money. I was able to purchase a home, a car, a couple rentals, and financed each purchase with historically low interest rates. Now that rates have shifted and are closer to historic norms, I think we should look at the benefits and drawbacks to the new environment. This is part one of a two-part income series looking at interest rates and simply the benefits, drawbacks, and the couple things you can do in either environment to take advantage.

While often viewed negatively due to higher borrowing costs, there are also significant benefits specific to your investment portfolio associated with higher interest rates:

- Increased Savings Returns: Higher interest rates directly benefit savers and those with money in interest-bearing accounts. When banks offer higher interest on savings accounts, certificates of deposit (CDs), and other savings instruments, individuals earn more on their deposited funds. This can encourage saving, contributing to personal financial stability and providing individuals with a larger financial cushion. We added a question to our client discussions that didn’t hold much weight before 2022…What are you earning at the bank? Prior to 2022, it just didn’t matter. You could earn 100% more from one savings account to the other and simply go from 0.05% to 0.10%. Today though… the range is massive, from as small as less than 1% to as high as close to 5% in a FDIC insured Savings account. If you’re open to a money market fund, you can likely earn more. This is different, this is great, this should be paid attention to, but don’t get caught in the Cash Trap.

- Inflation Control: “Inflation” could have been the word of the year in 2022. (According to Merriam-Webster, it was gaslighting, just if you’re wondering. I know I was.) You couldn’t open a newspaper (app) without seeing at least a couple articles about inflation…the price of eggs, the cost of a used car, airline tickets. In 2022, Operation: Control Inflation, controlled by the Federal Reserve increasing interest rates, started and didn’t stop until the middle of 2023. When the Fed Funds rate went from 0% at the beginning of 2022 to 5.5% today*. One of the primary reasons central banks increase interest rates is to control inflation. Higher interest rates make borrowing more expensive, which can reduce spending and investment. The goal is that this slowdown in demand can help reduce the rate of inflation, maintaining the purchasing power of the currency. Some inflation is an important piece of growth in the economy, however, controlling significant inflation is crucial for economic stability. Unchecked inflation can erode savings, reduce the standard of living, and create uncertainty in the economy. It also takes time and can have unintended consequences. Increasing interest rates usually take at least 12 months for a change to have a widespread economic impact and can impact gross domestic product for up to 12 years, according to research by the Federal Reserve Bank of San Francisco.

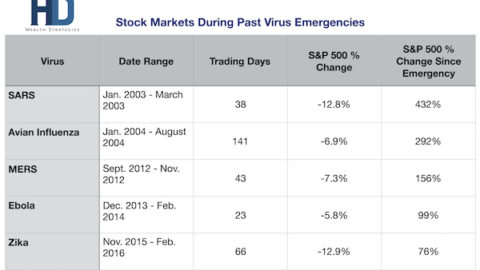

- Fixed-Income Investments: Higher interest rates generally lead to lower prices for existing bonds, as newer bonds are issued at the higher rates, making them more attractive to investors. For portfolios holding a significant amount of fixed-income securities, this can lead to decreased market value in the short term. This increase in rates is what lead to a difficult 2022 for the bond market and contributed to multiple high-profile regional banks suddenly collapsing in early 2023: Silicon Valley Bank (SVB), Signature Bank, and First Republic Bank. However, higher rates also mean that the income generated from new bonds or reinvested funds will be at these higher rates, potentially increasing the income component of the portfolio over time. As an investor, if you’re able to earn more from the safer part of the portfolio, you are likely able to achieve a similar risk adjusted return with less equity risk. Simply put, possibly less risk, similar return.

Higher rates are not all bad and likely an environment we may need to get used to as Jerome Powell and the Fed continue to reinforce the higher for longer strategy. For the other side of this story, stay tuned to our part two of this Income Series: Part Two 3 benefits of lower interest rates.

*CNBC.com

Securities offered through LPL Financial, Member FINRA/SIPC. Investment advice offered through Higgins & Schmidt Wealth Strategies, a registered investment advisor and separate entity from LPL Financial.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results.

CDs are FDIC insured to specific limits and offer a fixed rate of return if held to maturity, whereas investing in securities is subject to market risk including loss of principal.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification and asset allocation does not ensure a profit or protect against a loss. Stock investing involves risk including loss of principal.

Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price. Rebalancing a portfolio may cause investors to incur tax liabilities and/or transaction costs and does not assure a profit or protect against a loss.