Our Investment Process: The Sixth Tactical Rebalance of 2020

By Steven Higgins, Financial Advisor, Principal

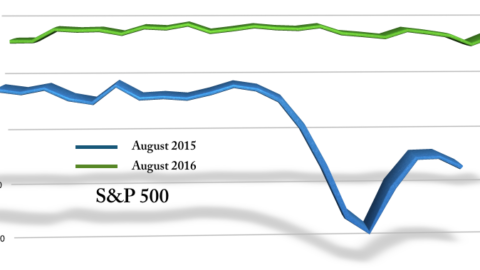

People need little convincing that this year has presented challenges in almost every corner of our lives. Financial advisors and their clients have faced the unique challenge of sticking to strategies and long-term goals with limitations on communication and support. At HDWS, we adhere to strict processes that guide our communications, our strategies, and most certainly our investment strategies. The redundancies, systems, and most importantly the people we put in place before the pandemic proved to be more than able to meet the challenge. While the stock market correction associated with the sudden onset of the COVID-19 pandemic recovered to set new record highs less than six months after bouncing off of the bottom of what was the fastest 30% correction in history, we stayed conscious of and ready for the reappearance of volatility events, which are completely normal and expected. This week saw the S&P 500 index very briefly clip the -10% threshold, triggering our sixth tactical rebalance of 2020.

February 19th, 2020 marked the moment investors turned their attention to the swelling COVID-19 pandemic. By March 23, the S&P 500 completed one of the fastest corrections ever, falling nearly 34% from the record high in just over a month. Along the way down our investment process guided three separate tactical repositions in our investment models which incrementally maintained or increased the percentage of stocks in our models as stocks got cheaper. To be clear, we were “buying low.” By summer, the S&P 500 had largely recovered with the index up over 40% from the March 23 low. At that point we executed a complete rebalance returning our investment models to pre-pandemic allocation percentages. August saw positive returns of 7% in the S&P 500 essentially capping off what was nearly a 50% increase since the March low. September brought a return of volatility and the gyrations caused the S&P 500, ever so briefly to cross the -10% correction threshold. The arrival of the first 10% downward move in almost six months triggered, once again, our investment process and we made an incremental adjustment to our models for the benefit of our clients. The correction proved at this point to be fleeting as stocks immediately began a partial recovery.

We have cautioned our clients to be prepared for the return of volatility. The pandemic and economic impacts are still very much a force and the coming election is a natural and expected catalyst for uncertainty and corresponding volatility. You can be certain that we are poised and prepared for what we fully expect to be a trying season as we work the through uncertainty, the election outcomes, and continued progression through the pandemic. Our client’s long-term goals are paramount and at the forefront of our processes and efforts. For more insight regarding our investment process through the COVID-19 volatility event, check out our COVID-19 Volatility Resources Page.

*S&P 500 data obtained from ycharts.com

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful. Rebalancing a portfolio may cause investors to incur tax liabilities and/or transaction costs and does not assure a profit or protect against a loss. Stock investing involves risk including loss of principal. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.