Municipal Bonds in a COVID-19 Economy

HDWS’ interview with Thornburg Investments Client Portfolio Manager

By Steven Higgins, Financial Advisor, Principal

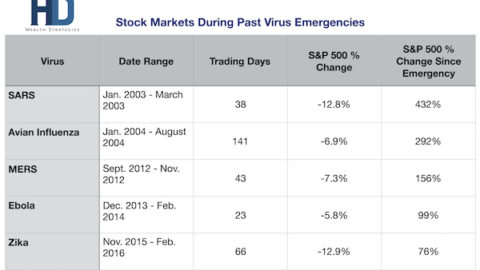

Investment conversations in 2020 have been dominated by the whipsaw stock market. The headline grabbing volatility of the major indexes has been about as much a part of the Covid conversation as Covid itself. Municipal bonds, the tax advantaged counterpart to corporate bonds, serve as borrowing vehicles for projects and services by local and state governments. Investment grade municipal bonds are historically a relatively safe investment. In fact, only the United States Treasury is considered more safe. Despite the historically strong track record and unique tax features, there are many misconceptions and misbeliefs about municipal bonds. As every recession heightens investor’s worries this time is no different.

At HD Wealth Strategies we use municipal bonds to add quality diversification and tax efficiency to our client’s tax sensitive portfolios. My partner, Allison Schmidt, and I recently had the opportunity to interview Dominic Alto, Client Portfolio Manager for Thornburg Investment Management, a well known manager of investment funds with expertise in municipal bonds. In our interview with Mr. Alto, we discuss risks and opportunities in the municipal bond space, misunderstandings about bankruptcy as it pertains to state and local governments, and the impact of the economic shutdown caused by the COVID-19 pandemic.

As part of our investment process, Allie and I consistently perform due diligence on the investment classes that make up our portfolio allocations, as well as the managers that manage the individual investment funds. As part of our client experience we seek out thought leaders in the industry who bring insight and context to our clients to help create a more informed partnership between us here at HD Wealth Strategies and you, our client. As always, if you have any questions that may be appropriate topics for blog posts or videos, please don’t hesitate to let us know.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of recommendations for any individual. All performance referenced is historical and is no guarantee of future results. The opinions expressed in this material do not necessarily reflect the views of LPL Financial. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. All investing, including stocks, involves risk including loss of principal. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price. The Dow Jones Industrial Average is comprised of 30 stocks that are major factors in their industries and widely held by individuals and institutional investors. The S&P 500 is a stock market index that tracks the 500 most widely held stocks on the New York Stock Exchange or NASDAQ. All indices are unmanaged and may not be invested into directly. Any named entity, HD Wealth Strategies, and LPL Financial are not affiliated. This information is not intended to be a substitute for specific individualized advice.