The S&P Just Notched a New All-Time High….So, What Did You Do?

By Steven Higgins, Financial Advisor, Principal

Last Wednesday, April 23, the S&P 500, a widely held index of U.S. stocks, established a new record high replacing September 21, 2018 as the top of the mountain. The task to set a new high took seven months, with the bottom being December 24, 2018 after the index slid 20%. While no correction is easy, this correction and subsequent recovery was a “cake walk.” Examining all corrections of at least 20% since 1965 (there have been eleven), we see that the average correction is -31.84% and lasts 1084 days. In comparison the Great Correction of 2018 was small and short.

To be clear, the “haters” lost again. With markets basking in the light of records, every single person who has ever graced the studio of your favorite business channel or newspaper exposing “the end of the markets” or the presence of a dark “new normal” are proven wrong…again. However, it’s unfortunate and repeatedly true that it’s not markets that hurt people. It’s poor, emotionally driven decisions that hurt people and that includes the sales practices of inappropriate financial products that take advantage of those emotions.

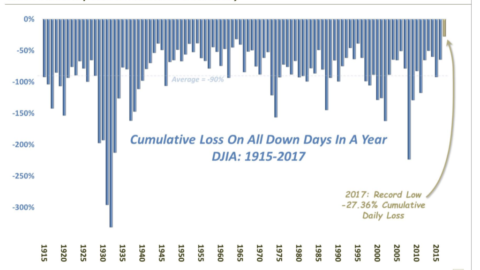

One of the simplest truths investors should acknowledge is: Volatility is normal, and you MUST own high quality investments over long periods of time for investing to work. There are no shortcuts, get rich quick schemes, and you can’t have your cake and eat it too; no matter how good the sales pitch is.

So, what did you do? Certainly it didn’t feel good to see the market bottom out on Christmas Eve. We heard everything from, “This is the next big one” to “this is nothing, let’s buy stocks.” Did you stay the course or maybe buy stocks? Or did you sell? Either way, there is a lesson to be learned from all of this; Make sure you are invested in a way that will not only meet your goals, but in a way that you can handle normal market environments. The 20% correction we just endured is normal; it was the 12th since 1965. Quick math: that’s once every 4.5 years. Since the year 2000 we’ve had three 20%+ corrections and the S&P 500 is up almost 200%.

At HD Wealth Strategies, we create a Personal Investment Policy (P.I.P.) with our clients. In the PIP we establish expectations, and understandings that will allow us as advisors to help our clients replace the unavoidable emotions that accompany market volatility with a sound strategy. If you are not aligning your goals, expectations, and resources, it’s only a matter of time before you find yourself beat by the market, which if given enough time, has never lost.

Interesting Take Aways From the New Market Highs.

- Going back to 1950, the average 12- month gain from a new high for the S&P 500 has been 9.8%. (excluding dividends) – LPL Research

- Markets are hitting new highs, but investors are not overly optimistic. Just 33.5% of investors are bullish. – American Association of Individual Investors

- Historically when U.S. Stocks have gone six months without a record, investors have had to with much longer for new highs. The S&P 500 has taken an average of 25 months to post new highs in times that it hasn’t hit a record within six months. This time it took just 7 months. – LPL Research

Securities offered through LPL Financial, Member FINRA/SIPC. Investment Advice offered through HD Wealth Strategies, a registered investment advisor and separate entity from LPL Financial. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

Financial Data Sources: Y Charts.

The Standard & Poor’s 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.