Does Investment Allocation Really Matter?

By: Allie (DeYoung) Schmidt, Financial Advisor, CFP®, CPA

You can’t watch TV or open a magazine without seeing a financial advisory firm such as Edward Jones or Raymond James – or even HD Wealth Strategies – ad or article talking about the importance of allocation and diversification of investments. So, you may be wondering if they’re just trying to sell you something or if these things actually matter to you and your family as you accumulate or maintain your wealth over time.

The Baseline:

Let’s say you have the allocation that’s appropriate for you, which is hypothetically a portfolio of 75% stocks and 25% bonds.

Because all markets move every trading day, this breakdown is likely only this EXACT breakdown for a short period of trading days. Markets vary, economics change, presidential nominees become presumptive, and those investments likely do one of two things: they go up or they go down.

Bull Market: they go up.

If the Stock Market goes up 30% (such as in 2013), 75% of your portfolio (the stocks) could potentially increase by 30%, and bonds may stay put: now you’re at 80% stocks and 20% bonds. If you don’t rebalance and recognize some of your gains and purchase more bonds to rebalance your risk assumed, you’re likely taking on generally MORE risk (stocks tend to be more volatile than bonds). You could be caught off guard with “statement shock” if the stock market reverses direction and declines. Remember, sell high.

If the Stock Market goes up 30% (such as in 2013), 75% of your portfolio (the stocks) could potentially increase by 30%, and bonds may stay put: now you’re at 80% stocks and 20% bonds. If you don’t rebalance and recognize some of your gains and purchase more bonds to rebalance your risk assumed, you’re likely taking on generally MORE risk (stocks tend to be more volatile than bonds). You could be caught off guard with “statement shock” if the stock market reverses direction and declines. Remember, sell high.

Bear Market: they go down.

If the Stock Market goes down by 50% (in 2008), 75% of your portfolio could potentially decline by 50%, and bonds stay put: now you may be at 60% stocks and 40% bonds. If you don’t rebalance and purchase stocks, you’re taking on generally LESS risk for the recovery. You took on 75% stock risk heading into the recession and just 60% stock risk heading into the recovery. A full 20% less. You’re not positioned to regain what you lost, making the trek back more difficult. Remember, buy low.

If the Stock Market goes down by 50% (in 2008), 75% of your portfolio could potentially decline by 50%, and bonds stay put: now you may be at 60% stocks and 40% bonds. If you don’t rebalance and purchase stocks, you’re taking on generally LESS risk for the recovery. You took on 75% stock risk heading into the recession and just 60% stock risk heading into the recovery. A full 20% less. You’re not positioned to regain what you lost, making the trek back more difficult. Remember, buy low.

Now these are extreme one-year examples; however, imagine an investment account that was set up years or even decades ago. Imagine the disarray and potential opportunities lost. Be sure to pay attention to specific balances and breakdowns. Creating the initial allocation that’s appropriate for you is important; however, maintaining that balance and adjusting the balance as markets move and your life changes could be the most important for accumulating and maintaining wealth over time. Talk to your financial advisor about reviewing and rebalancing your asset allocation. This rebalancing technique also helps investors to continue to buy low and sell high.

*Please note this is a very generic investment portfolio and more sectors and investment types are necessary for an appropriately diversified portfolio.

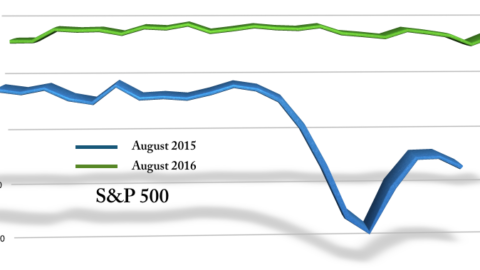

DISCLOSURE: The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. Stock investing involves risk including loss of principal. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price. Asset allocation does not ensure a profit or protect against a loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. Rebalancing a portfolio may cause investors to incur tax liabilities and/or transaction costs and does not assure a profit or protect against a loss. Financial data provided by Yahoo Finance.