3 Tax Season Take-Aways

3 Tax Season Take-Aways

Written by: Allie Schmidt, Financial Advisor, CFP®, CPA

The official 2016 tax season has just drawn to a close, for those of us who didn’t file an extension. I wanted to take a minute to look back and identify a couple take-aways to keep in mind in the coming year.

- Roth Conversion “do over!”: There are not many take-backs or do-overs when it comes to the IRS and incurring taxes, but a Roth Conversion is one of them. There are many good reasons to do a Roth Conversion to take advantage of long-term tax free growth. However, there are also many good reasons to reverse that decision if circumstances change. Circumstances, such as, your taxable income for that year ended up being higher than you anticipated from an unexpected bonus or increase in salary, or the assets that you converted declined in value, making the amount you’re paying tax on higher than what it was when you converted. Whatever the reason, the IRS does give the green light to change your mind and recharacterize the Traditional IRA to a Roth IRA conversion. It just needs to be completed by the last date, including extensions, for filing or refiling a prior-year tax return, which is typically on or about October 15. You’re not even locked there, assets that are recharacterized to a traditional IRA can be reconverted back to a Roth IRA in the next tax year after the conversion or 30 days after the recharacterization, whichever is later. (According to IRS.gov “Recharacterizations” in Publication 590-A).

- 401k contributions vs. IRA contributions: If you want to maximize your contributions to your 401k or IRA, remember the timeline to do so is different. To maximize your tax deductible contributions into your 401k at work from salary deferrals must be completed in the calendar tax year, December 31st. Whereas, if you qualify for tax deductible contributions to your Traditional or SEP IRA, you’re able to make those contributions until the tax filing deadline of April 15th. This is the same as contributions to your Health Savings Account (“HSA”). You’re able to make those contributions for the prior year until April 15th as well.

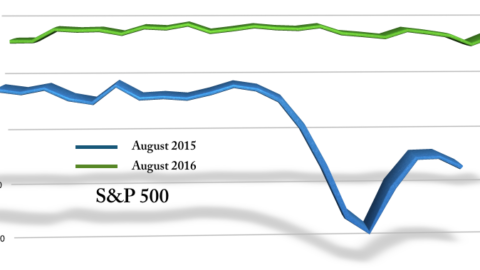

- Trump’s Individual & Corporate tax cuts: Stay tuned! As I’m writing this today, we don’t have many concrete details as to what these potential tax cuts may be or who they may help or hurt. Make sure to pay close attention to the impact on you and your family, especially when considering whether to do a Roth Conversion (or did a Roth Conversion, see #1), or which account to contribute to, pre-tax or post-tax. Hopefully we have a good understanding of any potential changes by the end of the year so we can all plan accordingly.

As always be sure to sit down with your tax accountant and financial advisor to discuss your specific situation and what is best for you and your family. After that, sit back and relax…you don’t have to deal with preparing your taxes for at least a couple months.

While we are familiar with the tax provisions of the issues presented herein, as Financial Advisors of RJFS, we are not qualified to render advice on tax matters. You should discuss tax matters with the appropriate professional. Unless certain criteria are met, Roth IRA owners must be 59 1/2 or older and have held the IRA for five years before tax-free withdrawals are permitted. Additionally, each converted amount may be subject to its own five-year holding period.