2022 Market Volatility

Inflation, interest rates, & geopolitics drive volatility

By: Allison Schmidt, CPA, CFP®

The market, as measured by the S&P 500, is currently trading about 10% below the all-time high set on January 4th of this year. This technical correction started off with investor concerns surrounding inflation and increasing interest rates, but has now shifted to geopolitical concerns about the Russian invasion into Ukraine. While inflation, the Fed tightening, and geopolitical risks are not necessarily new, they are concerns that investors have not had to face in quite some time and we’re seeing that unsettling reality play out in a volatile stock market since the beginning of the year.

While we don’t know what’s next for each scenario, according to Haver Analytics, stock market drawdowns from geopolitical shocks have historically averaged about 5% with recovery lasting under two months. At the end of the day, we’re not sure how this one, this time, will play out.

But, despite uncertainty and a slightly different set of market decline headlines, we believe this market decline is very normal. When we build portfolios for our clients, we anticipate this type of market movement occurring about every 12-24 months and when we look back, our last market correction was in September of 2020, so by most measures, this one is right on time.

We certainly don’t want to discount the current environment, the human toll, or to downplay how unsettling market movement can be for our clients. However, when we take a step back and look to history, similar market corrections, and even significantly worse market declines have become a part of the normal course of stock investing. This is why we created a very intentional, tactical investment management process that enables us to reduce risk when markets are going up, such as last year, and seek opportunity when markets are falling. At the end of the day, we want to make sure you have at least the same amount, if not slightly more, stock at the bottom of the correction as you did at the top to ensure your account recovers appropriately.

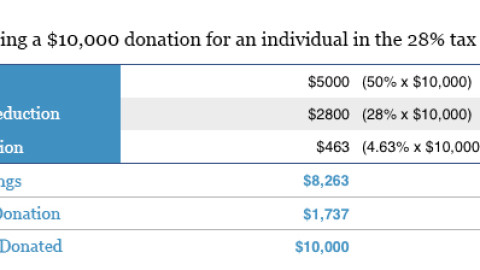

Your portfolio is built not to avoid these market corrections – or even bear markets, when they arrive – but to navigate them. As a part of our process, you’ve likely seen the trade confirmations in your inbox to show that we reduced risk exposure at the end of the year and then made our first tactical buy across accounts when the S&P 500 ticked 10% below it’s all time high. You can trust that we will continue to monitor market movement and take advantage of the opportunities that are presented. This will be in the form of tactical stock purchases, strategic income withdrawals, and potentially Roth conversions.

We don’t know what will happen over the next couple weeks, or even months. We think it’s important to focus on your long-term goals and where we’ll be 2, 3, and even 5 years from now; and we believe we will be in a better position than we are today.

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change. References to markets, asset classes, and sectors are generally regarding the corresponding market index. Indexes are unmanaged statistical composites and cannot be invested into directly.

Index performance is not indicative of the performance of any investment and do not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

All index data from YCharts.

All information is believed to be from reliable sources; however, LPL Financial and Higgins & Schmidt Wealth Strategies make no representation as to its completeness or accuracy.