As Expected: Inflation & Volatility Kick off 2022

By Steven Higgins, Financial Advisor, Principal

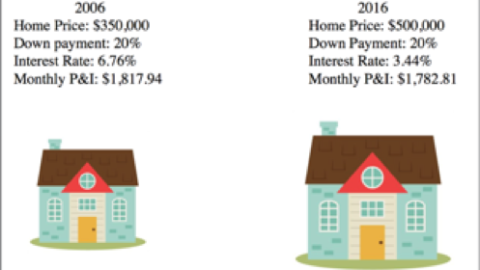

As we begin 2022, it is clear what the catalyst for market activity is going to be for the foreseeable future. Headlines might suggest an element of surprise regarding the reality that inflation and corresponding interest rate increases led to January’s market volatility. At Higgins & Schmidt Wealth Strategies, we have been prepared for this scenario and have been communicating and preparing our clients for volatility as markets and policies adjust to inflation and interest rate changes. Starting in 2017, we have been building portfolios and financial strategies in-line with our consistent narrative that long-term increases to money supply and ultra-low interest rates would eventually lead to inflation after decades of it being seemingly absent from the economic equation. A key element to our investment process is the acknowledgment of economic realities such as inflation and interest rate risk. We have, for some time now, positioned our client’s portfolios to positively correlate to increasing inflation while reducing interstate risk. In short, we have maintained significant positions in high quality domestic stocks and reduced exposure to interest sensitive asset classes such as long-term bonds. We continue to view volatility like we saw in January as normal, acceptable, and for our clients, an opportunity.

In 2020, we executed tactical changes to portfolios as the COVID driven market volatility provided significant investment opportunities for a clients. 2021 was quite different with 10 of 12 months positive. The stock market didn’t see a single correction of 10%, which is fairly unique. On three occasions, we rebalanced our qualified portfolios reducing risk as the market continued to glide higher. On New Year’s Eve, just hours before corks started popping off bottles of champagne and the market capped off a year at all-time high levels, we rebalanced portfolios to make a significant reduction in stock holdings. Just two trading days later, the tremors of market volatility revealed that January was going to be rocky. After a year of gains upon gains, the market (as we expected) was shuddering, thanks to a Federal Reserve that was projecting a hawkish stance in the face of mounting pressure to curb a tide of inflation that turned out to be more lasting than they originally assumed. In a brief moment the stock market, measured by the S&P 500, dropped by 10% from the all-time high set in early January 2022. In those brief moments we initiated a reposition in our client’s qualified portfolios increasing stock allocations, our first opportunity to do so in over 18 months. By the end of the day the stock market recaptured all of the days early losses. The week continued to remain volatile, ultimately finishing sightly positive.

Last week’s volatility and opportunity for our clients was fleeting. It was once again an example of how adhering to a predetermined process was instrumental in affecting a positive outcome for our clients and using a brief moment of chaos to move a little closer to achieving long-term goals. We absolutely expect volatility to persist throughout the year. Our clients should expect a year unlike last year. In a sense, a year like 2021 can lull people into a false sense of security. Every year is not a smooth path to gains. In fact, history tells us about 1 out of every 4 years turns out to be negative. Nobody knows how the year will progress but we most certainly have a process that will help our clients move forward and make another step towards reaching goals. We always encourage our clients to remember we are a planning centric firm, with a singular focus of serving our clients. If you have any questions, don’t hesitate to let us know.

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The opinions expressed in this material do not necessarily reflect the views of LPL Financial. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful. This is a hypothetical example and is not representative of any specific situation. Your results will vary. The hypothetical rates of return used do not reflect the deduction of fees and charges inherent to investing. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. The prices of small and mid-cap stocks are generally more volatile that large cap stocks. Stock investing involves risk including loss of principal. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price. Fixed annuities are long-term investment vehicles designed for retirement purposes. Gains from tax-deferred investments are taxable as ordinary income upon withdrawal. Guarantees are based on the claims paying ability of the issuing company. Withdrawals made prior to age 59 are subject to a 10% IRA penalty tax and surrender charges may apply. The Standard & Poor’s 500 Index is a capitalization weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries. The Dow Jones Industrial Average is comprised of 30 stocks that are major factors in their industries and widely held by individuals and institutional investors.