CLICK HERE TO RSVP

High Tech Meets High Touch at HD Wealth Strategies Using Technology to Pursue Deeper Relationships

Steven Higgins, Financial Advisor, Principal, , AllHigh Tech Meets High Touch at HD Wealth Strategies Using Technology to Pursue Deeper Relationships By Steven Higgins, Financial...

Inflation: It’s Baaack! Event Recap Thanks for joining us at our Lunch & Learn and Brews & News events. ...

Key Year-End Financial Planning Written by: Allie Schmidt, Financial Advisor, CFP®, CPA It’s hard to believe we’re already just...

Welcome, Amber! We are very excited to introduce to you our new Client Service Associate, Amber Bailey Klovski! Amber...

Vroom, Vroom Written by Allie Schmidt, Financial Advisor, CFP®, CPA Cars…Some people love them, some loathe them. If it...

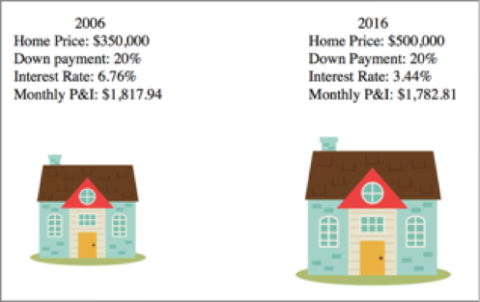

Housing prices boom but monthly payments remain steady? Written by: Allie Schmidt, Financial Advisor, CFP ®, CPA We’ve all...

How Was I Supposed to Know That? Written By: Allie Schmidt, Financial Advisor, CFP®, CPA I sat down with...

What Return Are You Really Earning On Your Money?

Allison Schmidt, Financial Advisor, CFP ®, CPA, , AllWhat Return Are You Really Earning On Your Money? By: Allie Schmidt, Financial Advisor, CFP®, CPA Most investors want...

3 Tax Season Take-Aways Written by: Allie Schmidt, Financial Advisor, CFP®, CPA The official 2016 tax season has just...

Donate to the Cause

Higgins & Schmidt

Wealth Strategies

Recent Posts

Categories

Disclaimer Corner

Securities offered through LPL Financial, Member FINRA/SIPC. Investment advice offered through Higgins & Schmidt Wealth Strategies, a registered investment advisor and separate entity from LPL Financial. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification and asset allocation does not ensure a profit or protect against a loss. Stock investing involves risk including loss of principal. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price. Rebalancing a portfolio may cause investors to incur tax liabilities and/or transaction costs and does not assure a profit or protect against a loss.