Working Remotely at Full Capacity A Message From Allie and Steve Due to the spread of the coronavirus and...

Coronavirus Volatility – Our Process A Message from Allie & Steve We are certainly in un-charted territory with the...

Coronavirus Update & Virtual Meeting Replay By: Steven Higgins, Financial Advisor, Principal & Allie Schmidt, Financial Advisor, CFP®, CPA On...

Coronavirus and the Markets: A Message from Allie and Steve

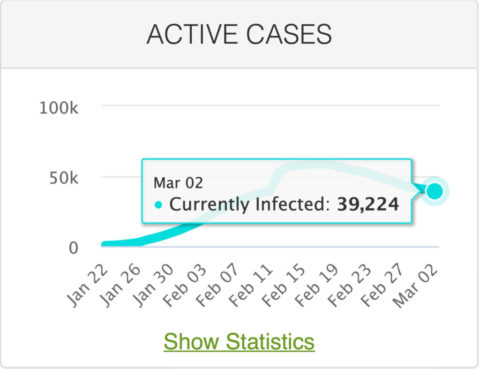

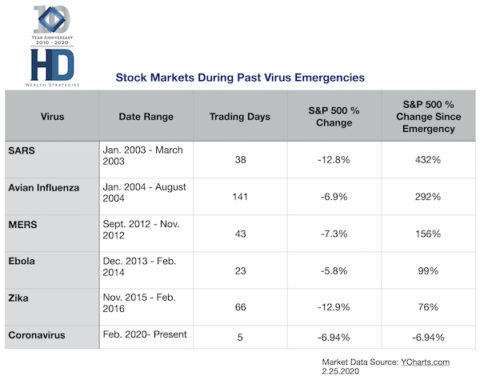

Steven Higgins, Financial Advisor, Principal, , AllCoronavirus and the Markets A Message from Allie and Steve We wanted to address the market over the past...

Have minor children? Consider a trust. Written by: Allie Schmidt, Financial Advisor, CFP®, CPA We just had our second...

Testing the Hypothesis: Addressing the Narrative of Fear

Steven Higgins, Financial Advisor, Principal, , AllTesting the Hypothesis Addressing the Narrative of Fear… A look back at our post from September 2019 By: Steven...

3 Reasons to Rebalance Written by: Allie Schmidt, Financial Advisor, CFP®, CPA Happy New Year! Here at HD Wealth...

The 3 Most Significant Issues for Investors as We Begin 2020

Steven Higgins, Financial Advisor, Principal, , AllThe 3 Most Significant Issues for Investors as We Begin 2020 By: Steven Higgins, Financial Advisor, Principal After closing...

The Best Posts of 2019 Our Favorite Blog Posts from the Past Year Written By: Steven Higgins, Financial Advisor,...

Reasons to be Thankful in 2019 By: Steven Higgins, Financial Advisor, Principal As 2019 charges into the holiday season...

Donate to the Cause

Higgins & Schmidt

Wealth Strategies

Recent Posts

Categories

Disclaimer Corner

Securities offered through LPL Financial, Member FINRA/SIPC. Investment advice offered through Higgins & Schmidt Wealth Strategies, a registered investment advisor and separate entity from LPL Financial. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification and asset allocation does not ensure a profit or protect against a loss. Stock investing involves risk including loss of principal. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price. Rebalancing a portfolio may cause investors to incur tax liabilities and/or transaction costs and does not assure a profit or protect against a loss.