Bull Market Faces Another Volatility Test

Putting Bull Market Volatility in Historical Context

By Steven Higgins, Financial Advisor, Registered Principal

The recent stock market volatility has served as an unsettling reminder that there is no such thing as blue skies for investors. At the close of the market on Monday, the S&P 500, an index comprised of the 500 largest publicly traded companies in the US, closed 8.5% away from its all-time high set earlier this summer. While still posting nearly double digit returns for the year, the S&P 500 along with other indexes threw their collective cold water in the face of some investors who had been lulled to sleep by what has been a rather peaceful market recovery turned bull market so far this year. We know that market gyrations are very normal, even in bull markets. In fact, the absence of volatility is more abnormal. Still the suddenness of these moments can challenge one’s emotional constitution and that is also normal and it’s okay.

For two years ending in January of this year, the stock market labored through an inflation induced bear market with the S&P 500 marking a low, -25% off its 2021 high on October, 11 2022. Since then the market has climbed the “wall of worry” seemingly shrugging off a relentless onslaught of negative headlines about war, bank failures, inflation, interest rates, and political turmoil. The data shows the markets weren’t oblivious to the treacherous world rather more motivated by the reality that the inflation battle was being won well before people were ready to admit it. As early as July of 2022 we saw monthly inflation data declining rapidly. The positive, inflation data gave hope for the prospect of a less hawkish Federal Reserve. Now, here we are, two years later, nearly a year removed from the last interest rate hike and likely on the cusp of an interest rate cut in September. The mythical “soft landing” seems to have been achieved although some would suggest that the Fed’s historically aggressive inflation response, may still lead to something of a “mild recession.” It’s those fears that sparked the volatility over the last couple of weeks. The stock market, having stair stepped its way higher for most of the year lost some lift and gave up some ground.

These moments are altogether normal events. Looking back at all of the modern bull markets we can see that every one of them experienced meaningful volatility during the course of the expansion. Note: a correction of 20% in given index will signal the end of a bull market and beginning of a bear market so the deepest a market correction can be while keeping the bull market intact is effectively 19.99%. There have been 11 bull markets since 1957. The average length has been 65 months, a bit over 5 years. The average cumulative return has been 184%. The average maximum market decline has been -14%. There were three bull markets that pushed the limits with declines of 19%. To put the current bull market in perspective, we are 22 months into this thing. The total return has been 45%. The maximum decline has been 10% and that came in October of 2023.

All the data and historical context in the world doesn’t do a whole lot of good if you don’t have an investment process that aligns with your financial plan and your long-term goals. It is imperative that our planning process accounts for what is normal and market volatility is normal. So with the expectation that the future will be just as serrated as the past we manage portfolios to provide for stability and liquidity for up to five years of a client’s income needs. Beyond that, we utilize an investment process that is built on modern portfolio theory, which essentially prioritizes diversification of quality assets. We give credence to macro economic realities such as interest rates and inflation. Finally, we use a tactical rebalancing strategy that removes emotion from the time tested, yet emotionally challenging process of buying low and selling high. We make small adjustments to portfolios to reduce risk exposure as markets are rising and we take advantage of market volatility to increase allocations to quality investments at lower prices. We avoid speculation and we don’t have a crystal ball. It’s important for our clients to have confidence in their portfolios and their financial goals and planning. We understand and respect that the resources our clients have amassed represent their life’s work and stewardship. We take our responsibility seriously and we stay highly conscious of the consequences of trust.

This too shall pass, but probably not as soon as we would all like. There are a lot of potential distractions out there that may get their moment in the headlines too. There are some very real and very human challenges ahead that need to be dealt with. But, challenges are part of the human experience and we’ll face those challenges and move on to new challenges. As always, it is our purpose to be a resource for our clients. If there are specific questions or concerns that you have, please reach out to our advisors. We work for you.

Securities offered through LPL Financial, Member FINRA/SIPC. Investment advice offered through Higgins & Schmidt Wealth Strategies, a registered investment advisor and separate entity from LPL Financial.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification and asset allocation does not ensure a profit or protect against a loss. Stock investing involves risk including loss of principal. Bonds are subject to market and interest rate risk if sold prior to maturity.

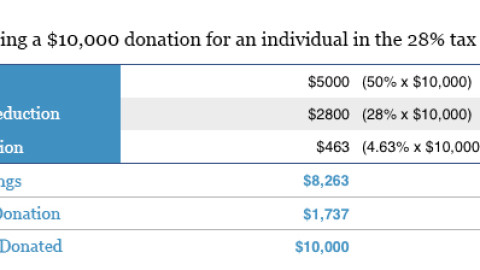

Bond values will decline as interest rates rise and bonds are subject to availability and change in price. Rebalancing a portfolio may cause investors to incur tax liabilities and/or transaction costs and does not assure a profit or protect against a loss. Contributions to a traditional IRA may be tax deductible in the contribution year, with current income tax due at withdrawal. Withdrawals prior to age 59 ½ may result in a 10% IRS penalty tax in addition to current income tax.