Throwing Caution to the Wind?

An Emotional Tug-O-War. A fear driven market is now awash with greed.

By Steven Higgins, Financial Advisor, Partner

Investor: ‘Should I buy (or short) GameStop, AMC, Bitcoin, Etc.?’

Answer:

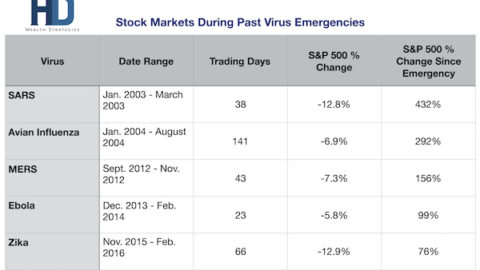

Just one year ago investors were reeling from one of the quickest and sharpest market crashes ever. While certainly not anywhere near historic in depth, the stock market drop resulting from the sudden arrival of the COVID-19 Pandemic caused the fastest crash of at least 30% in history. Fear was pervasive and investors, shell shocked, tried to figure out how long the pain would last. Headlines foretold of irreparable damages to the economy and markets, as well as looming depression. By August of the same year, the major stock market averages notched new all-time high marks and with barely a limp continued to climb to new highs through the end of the year and beyond. In just twelve short (or incredibly long) months, the fear that ran in the streets has turned to muddy puddles of greed and speculation as new, albeit temporary fortunes were created amidst the frenzy of speculation in the shares of companies like GameStop and AMC. The phenomenon driven by social media news aggregation and discussion website Reddit, caused near death companies like GameStop to see their share prices soar, then crash, then soar again day by day as the flash mob of Robinhood investors tried to put a “short squeeze” on large hedge fund managers who had bet big against the survival of the companies.

What Is a Short Squeeze? A short squeeze occurs when a stock or other asset jumps sharply higher, forcing traders who had bet that its price would fall, to buy it in order to forestall even greater losses. Their scramble to buy only adds to the upward pressure on the stock’s price. – Investopedia.com

This kind of frenetic headline driven investing drama can do just as much damage to an investor’s long-term success as the fear driven damage that is done when markets are scary, like last year. FOMO, or Fear Of Missing Out can cause an investor to look at their seemingly meager year-to-date return of 5% (more than a 20% annual rate) and think maybe they should be doing even better. That same investor was possibly crying in their carry-out last spring as the market was “certainly” crashing to the deepest parts of the darkest places of Hades. The truth is the investor who lacks an investment plan and process is often distracted or motivated by the belief that they have identified a sort of pattern or solution that just happens to correspond to the emotions they are feeling and the bad decision they desperately want to make. And, driving this naughty behavior are of course the most powerful emotions when it comes to investing: fear and greed.

What is FOMO? FOMO or Fear Of Missing Out is a social anxiety stemming from the belief that others might be having fun while the person experiencing the anxiety is not present. It is characterized by a desire to stay continually connected with what others are doing. FOMO is also defined as a fear of regret, which may lead to concerns that one might miss an opportunity for social interaction, a novel experience or a profitable investment. It is the fear that deciding not to participate is the wrong choice. – Wikipedia.com

Our job as the advisors for our clients is to create and communicate processes that are built to function in-line with the long-term goals and expectations of our clients. Of course, we’d all love to find instant wealth as the result of a quick bet and it would be even better if we could attribute that fortune not to luck but to our own financial acumen. The reality is, it is proven impossible that any investor can consistently win those big bets. Anybody placing a speculative bet should be fully prepared to lose all the money on the table. As stewards of our clients incredibly hard earned fortunes we simply aren’t going to speculate with our client’s money.

We often recognize that investors do not really understand the difference between risk and volatility. While risk comes in different forms (liquidity risk, inflation risk, interest rate risk, etc) we are going to focus on business risk, essentially the risk that you as an investor could lose all of your money because problems within the company or companies you’ve invested in have business problems that could cause them to fail.

What is Business Risk? Business Risk is the exposure a company or organization has to factor(s) that will lower its profits or lead it to fail. -Investopedia.com

Volatility on the other hand is the experience you as an investor feel as market forces move the value of your investment up and down. Volatility is a completely normal element of the markets. If an investor was certain that the value of an investment or portfolio of investments would always come back then nobody would be concerned with volatility. The problem is, the average investor can’t make the emotional distinction between business risk and volatility and when the markets turn over like they did in the COVID Spring of 2020 many people thought the logical conclusion was that the market would continue on it’s trajectory and ultimately it would all be worthless. In the absence of an investment process I suppose the best one can do is rely on knee-jerk logic….like running from a bear, we all know we shouldn’t do it but there’s a reason they always have to tell people not to.

We know the money we manage for clients represents the future, the dreams, the goals, and the needs for our clients and their families. Our clients can’t lose their money because they can’t lose what their money represents. So we have to do everything we can to reduce risk to the point where losing all of the money would be historically non-existent and going forward, extremely unlikely. We can’t and won’t guarantee the future because I have seen enough dystopian future movies (picture Mad Max) to know that ETFs, mutual funds, a solid investment process, and tax management will do you absolutely no good if/when that happens.

What is Mad Max? Mad Max is an Australian post-apocalyptic action film series that follows the adventures of Max Rockatansky, a police officer in a future Australia which is experiencing societal collapse due to war and critical resource shortages. -Wikipedia.com

At Higgins & Schmidt Wealth Strategies, we employ, as the foundation of our investment process, Modern Portfolio Theory, which is based on the premise that there is a limited amount of risk that an investor can withstand. By controlling for risk and volatility through the use of a widely diverse portfolio representing hundreds of stocks, bonds, and alternative assets from many industries and geographical areas we are able to maximize the return for an accepted amount of risk. Conversely we are able to, within reason, approximate an amount of risk or volatility possible for a stated or expected return.

What is Modern Portfolio Theory?

Modern Portfolio Theory is a theory on how risk-averse investors can construct portfolios to maximize expected return based on a given level of market risk. Harry Markowitz pioneered this theory in his paper “Portfolio Selection,” which was published in the Journal of Finance in 1952. He was later awarded a Nobel Prize for his work on modern portfolio theory. – Investopedia.com

We don’t expose our clients to “go-go stocks” and “meme investments” because it violates Modern Portfolio Theory and our first rule: Try not to lose our client’s money. The value in understanding the basics of Modern Portfolio Theory can be lost in the sterile and academic way the theory is usually explained. Let’s boil it down to this compromise: There should always be an understanding that any investment can drop in value by 4-6 times it’s expected rate of return. At Higgins & Schmidt we call it the “Investor’s Compromise.” Don’t look it up. We made it up and it’s not science. However, it can help keep you out of trouble. As part of our process, we simply won’t invest your money in anything “in hope” of a quick return that would subject you as an investor to a situation where we would expect you could lose all of your money. So when legends tell (via Twitter) of quick fortunes to be made in (insert latest investing fad), you should apply the compromise (5 X expected return = potential loss), and if the product is 100 or more just understand you have a very real possibility of losing all of your money. I am not saying you should never do it and I’m not saying it isn’t fun. I like Las Vegas and the requisite games of chance too, it’s just important to know the risk. What I am saying is that as part of our investment process, we don’t play games with our client’s money, future, dreams, goals, and needs. We follow a sound and disciplined investment process all the while communicating and refining our understanding of our client’s goals and expectations.

As financial advisors of an independent Registered Investment Advisory firm we serve individuals and families with minimum investable assets of over $500,000. We make significant and bold promises regarding service expectations to our clients. Implementing an investment minimum ensures that the growth of our business will not compromise our ability to keep our promises. Our clients find value in the ongoing planning and evaluation process which includes tax planning, estate planning, risk management, and income planning in addition to investment management. We are selectively accepting new clients. If you feel you or a friend may be a fit for a truly exceptional financial service experience, we would certainly appreciate the opportunity to share our story and our process.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful. Rebalancing a portfolio may cause investors to incur tax liabilities and/or transaction costs and does not assure a profit or protect against a loss. Stock investing involves risk including loss of principal. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.