Full Disclosure: Did Your Financial Advisor Take a PPP Loan?

Our Decision and Thoughts about our Own Experience

By: Steven Higgins, Financial Advisor, Principal

The $2 trillion Coronavirus Aid, Relief, and Economic Security Act, known as the CARES Act was passed in March to provide support to American families and businesses that were impacted by the economic shut down. A significant component of the CARES Act, the Paycheck Protection Program (PPP), was designed to help small businesses keep their employees on payroll, and if certain criteria are met, the loans are eligible for forgiveness.

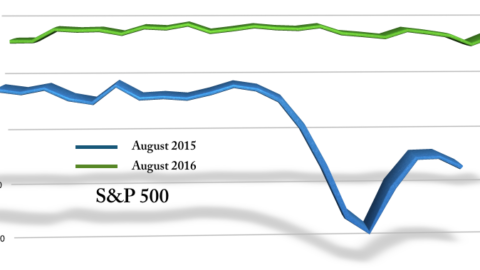

Stock market volatility is a normal part of our business. Twice in the last 20 years, the S&P 500, an index of 500 of the largest companies in America, has dropped by over 50%. So, the 35% drop last March was by no means historic.** However, the the global fury and fear that surrounded the Coronavirus was unique by any measure, and the associated economic shutdown was devastating, if not fatal, for many small businesses. The PPP loans administered by the Small Business Administration (SBA) were – without question – the difference between life and death for many businesses in our community. That being said, different types of businesses experienced the challenges to differing degrees. A restaurant, for example, may have lost all or most of their income in an instant. By contrast, a Registered Investment Advisory (RIA) firm like HD Wealth Strategies, with revenue determined by asset values of clients’ portfolios, experienced a decrease of revenue rather than an elimination of revenue. In an effort to get the assistance to businesses as fast as possible, the SBA imposed very few limits on applicants for the PPP. The rather brief application did include a key element, an attestation that read: “Current economic uncertainty makes this loan request necessary to support the ongoing operations of the applicant.” It was the consideration of this statement that guided our decision at HD Wealth Strategies to not accept the forgivable PPP loan.

According to the Small Business Administration, over 1,400 Registered Investment Advisory firms received a PPP loan. According to Forbes.com, the list of loan recipients included 28 of the top 100 firms in the nation. There is no doubt that the sudden chaos of March was unexpected and dramatic, causing unimaginable challenges to existence of business. Running a small business, advisory firms included, is very hard and we would never disparage a business owner for doing what they felt was in the best interest of their company in an effort to maintain solvency. At HD Wealth Strategies, we help our clients develop preparedness and strategies to handle expected market volatility and we practice those planning elements in our own business. Market corrections are challenging for everybody, and coupled with the anxiety and fear produced by the pandemic as well as the challenges of working and serving clients remotely, we faced challenges head on. Never were we close to a point where our ability to maintain our staff, our business, or our service to clients was in doubt and for that we are extremely thankful because clearly 1,400 advisory firms attested to that fact that they weren’t such a position.

To be honest, at first it seemed like free money and it basically was, in financial terms. Our initial application was promptly approved and it seemed as though we would meet the criteria for loan forgiveness. However, when we considered the true purpose of the program and our inability to honestly represent that our business was in dire circumstances, we decided against taking the funds. Every year, an RIA like HD Wealth Strategies is required to submit updates to the client disclosures. Known as the form ADV, it requires the disclosures of conflicts of interest, explanation of business, and potential impairments. One of the statements in the form ADV disclosure reads, “Neither HDWS nor its management have any financial conditions that are likely to reasonably impair our ability to meet contractual commitments to clients.”* Needless to say, explaining the conflict between this statement and the attestation in the PPP loan application would be awkward at least and fraudulent at the worst. Additionally, the government released the names of all of the businesses (including RIAs) who took over $150,000 and released simple business details, excluding names, for those businesses that took less than $150,000. This sudden spotlight has caused many businesses who possibly took advantage of the opportunity to swiftly announce repayment of the loans. James Angel, a professor of finance at Georgetown University McDonough School of Business said, “I expect many RIAs to return the funds in the near term in order to recapture the moral high ground that may have been lost as they did not face the same type of disruption in working from home as restaurants.”

The COVID-19 environment has presented significant challenges to everyone. As business owners and financial advisors we have to assess risk and opportunities for our clients as well as ourselves. The PPP loans and loan forgiveness were certainly seen as opportunities for some firms. For HD Wealth Strategies, we knew this was a key moment to shine a light on our processes and discipline while focusing on our relationships with clients to manage through the volatility, identify opportunity, and be stronger on the other side. To be transparent, our opportunity through these challenges is to grow the relationships we have with our current clients and earn the opportunity to be referred to our clients’ friends and family.

2020 has been quite the learning experience for all business owners. The unique challenges have also brought unique opportunities and risks. In light of that, HD Wealth Strategies is well poised to deliver on our commitments to our clients and our team.

*HD Wealth Strategies’ Form ADV, 2020 version, p.13

**ycharts.com

Securities offered through LPL Financial, Member FINRA/SIPC. Investment advice offered through HD Wealth Strategies, a registered investment advisor and separate entity from LPL Financial. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

All performance referenced in historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.