Is This Normal? The current market correction and talk of tariffs Written by: Steven Higgins, Financial Advisor, Principal &...

Will Individual Tax Reform Create New Opportunities?

Allison Schmidt, Financial Advisor, CFP ®, CPA, , AllWill Individual Tax Reform Create New Opportunities? By Allison Schmidt, Financial Advisor, CFP®, CPA The most wonderful time of...

What Have You Learned? Becoming a better investor and why you are not John Denver By Steven Higgins, Financial...

Inflation, Volatility, But No Surprises Four Reasons Why Inflation Will Continue to Drive the Story by Steven Higgins ...

Market Correction: By The Numbers By Allison Schmidt, CFP®, CPA Last week, we saw two 1,000 point dips in...

Market Volatility and Emotions By Steven Higgins, Financial Advisor, Principal Yesterday – Monday February 5 – saw the DOW...

Tax Reform … New Rules, Old Game Written by: Allie Schmidt, CFP® , CPA, Financial Advisor Tax reform has...

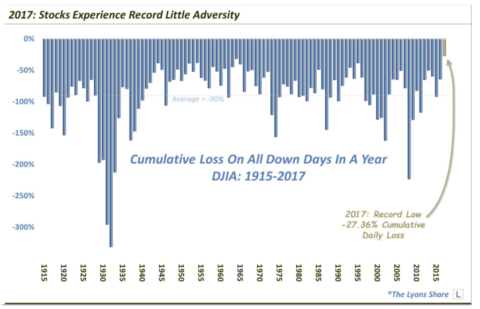

2017 Review & 2018 Preview By Steven Higgins, Financial Advisor In Review: Top Stories Affecting Our Clients In 2017...

Three Tips to Start 2018 Off Right By Allison Schmidt, Financial Advisor, CFP®, CPA Happy New Year! 2018 is...

Taking a Bite Out of Bitcoin By Steven Higgins, Financial Advisor, Principal Bitcoin is a major news story right...

Donate to the Cause

Higgins & Schmidt

Wealth Strategies

Recent Posts

Categories

Disclaimer Corner

Securities offered through LPL Financial, Member FINRA/SIPC. Investment advice offered through Higgins & Schmidt Wealth Strategies, a registered investment advisor and separate entity from LPL Financial. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification and asset allocation does not ensure a profit or protect against a loss. Stock investing involves risk including loss of principal. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price. Rebalancing a portfolio may cause investors to incur tax liabilities and/or transaction costs and does not assure a profit or protect against a loss.