Is Your Retirement Plan at Work Being Ignored? By Allie (DeYoung) Schmidt, Financial Advisor, CPA®, CFP The Rub When...

Author Archive for: aschmidt

Take it or Leave it: What to do with your “old” 401(k)

Allison Schmidt, Financial Advisor, CFP ®, CPA, , AllTake it or Leave it: What to do with your “old” 401(k) By: Allie (DeYoung) Schmidt, Financial Advisor, CFP®,...

Don’t believe everything you read. By now, we’re all familiar with the saying and its implications for our lives....

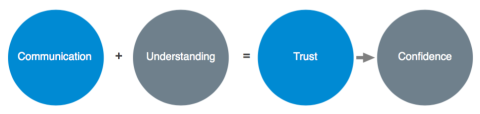

Some History HD Wealth Strategies stepped into the financial services scene in 2010 after the financial crisis of 2008,...

Competition Competition, as in many professional arenas, is remarkably fierce in the financial services sector. Two types of advisors have...

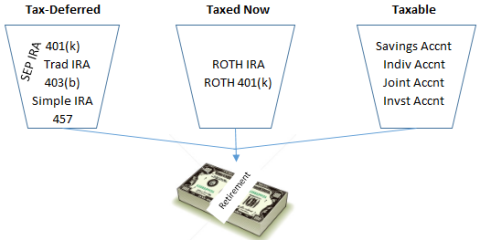

Recap: On Wednesday, March 16th we hosted a tax planning event entitled “Bracketology and Buckets” where Allie and Steve...

Then comes the baby in the baby carriage… Written by: Allie DeYoung, Financial Advisor, CFP®, CPA Exciting! You’ve started...

Dive Deeper into HD Wealth Strategies In addition to our website, we maintain a presence on many popular social...

Bracketology & Buckets: Tips to Keep Yourself in a Lower Tax Bracket Over Time. By: Allie Schmidt, Financial Advisor, CFP®,...

Risky Business By Allison DeYoung, CFP®, CPA We were all hit with a stark reminder in 2015 and the...

Donate to the Cause

Higgins & Schmidt

Wealth Strategies

Recent Posts

Categories

Disclaimer Corner

Securities offered through LPL Financial, Member FINRA/SIPC. Investment advice offered through Higgins & Schmidt Wealth Strategies, a registered investment advisor and separate entity from LPL Financial. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification and asset allocation does not ensure a profit or protect against a loss. Stock investing involves risk including loss of principal. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price. Rebalancing a portfolio may cause investors to incur tax liabilities and/or transaction costs and does not assure a profit or protect against a loss.