From Ashes to Opportunity

Understanding Unique Tax Opportunities Within Federally Declared Disasters

By Steven Higgins, Financial Advisor, Registered Principal

When an event is declared a Federal Disaster, the IRS provides an alternative set of rules with respect to how taxpayers account for losses that result from the disaster. These rules provide additional financial relief for those affected. With thoughtful planning, individuals and families can takes steps to save significant money on taxes, as well as strengthen the tax efficiency of their assets for years to come. The following is an overview of some of the opportunities that may serve as a benefit for people affected by the Boulder County fires of 2021. Every situation is unique and I recommend that each person consult professional advisors to determine what is best for themselves.

On December 30th, 2021, the wind blew relentlessly across the Marshall Mesa in Boulder County. The hurricane-force wind exacerbated the abnormally dry conditions that winter. The fire started east of the open space, and as the gusts encouraged the spread of the fire, the tragedy of the Marshall Fire began to unfold. By days end more than a thousand homes were completely destroyed. The entirety of families’ shelter, safety, and belongings were – almost instantly – lost. By sunrise the following morning, snow flakes began to fall on the still smoldering embers and as the year was coming to close, the challenge of recovering from a disaster of such magnitude was just beginning. There were countless frustrations lying ahead for so many families and even now, as newly built homes in various stages of completion line the streets of neighborhoods once engulfed by flames, hurdles remain as those affected fight and negotiate with insurance companies to be made whole.

My effort to find solutions revealed a significant opportunity with respect to the laws designed to assist those experiencing loss due to a federally declared disaster, like the Boulder County fires of 2021. The IRS provides guidance for dealing with regular losses such as theft, water damage, fire, etc. However, the rules change with respect to losses incurred during events that are declared by the President to be Federal Disasters. The Marshall fire is such an event. On January 1, 2022, President Biden approved the Major Disaster Declaration for Colorado providing federal assistance for damage resulting from straight line winds and wildfires. In addition to authorizing federal financial assistance, the declaration made it possible for those affected to utilize the the qualifying disaster loss provisions outlined in IRS Publication 547, Casualties, Disasters, and Thefts.

Important changes with respect to accounting for losses as a result of a federally declared disaster are the removal of the cap on the amount of losses that can be claimed and the absence of the requirement that losses may exceed 10% of a person’s adjusted gross income.Each situation is unique and I understand that there has been a lot of trauma experienced by families. My intention is to raise awareness about an opportunity not to give broad tax advice. So, in that spirit, the following are highlights of what may be an opportunity for you, your family, or a neighbor.

- Losses in excess of insurance reimbursements can be deducted against ordinary income. While regular losses are capped and may exceed 10% of a person’s adjusted gross income, this is not the case with losses that are incurred as a result of a federally declared disaster. The loss would be roughly calculated by adding the total loss of property (your home + personal property) and then subtracting the amount of insurance proceeds received. Because of the recent increase in home values and post pandemic inflation driving up replacement and building costs, many people found themselves to be significantly underinsured. For the Boulder County fires, it is common for the gap between total property losses and insurance proceeds to be in the hundreds of thousands of dollars.

- The IRS guidance states that a tax filer can claim the loss in the year that it is reasonably believed that there will be no more insurance reimbursements expected. The timing of your claim should be discussed with your tax preparer. For many, their homes are nearing completion and insurance claims and settlements have been completed. With final clarity on the gap between losses and reimbursement, it is likely that 2024 will be the appropriate year to claim the disaster loss for for many. If the appropriate year to claim the loss was a previous year, it may be well worth it to amend a previous year’s tax return.

- If your losses as result of a declared disaster exceed your income in the year in which you claim the loss, you are able to carry the Net Operating Loss forward to subsequent years. Keep in mind, this loss offsets ordinary income. It is not a capital loss.

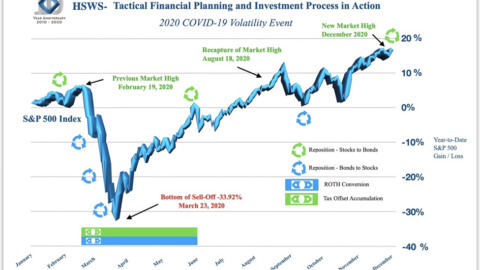

- Proper financial and tax planning can help you make the most of your losses. This is where a person can really make a difference for their financial future. By strategically utilizing the loss as a result of a federally declared disaster, a person may be able to offset income and tax associated with a ROTH IRA Conversion. A Roth Conversion is the practice of converting assets accumulated in a traditional IRA, 401(k), or similar retirement account to a ROTH IRA. In a traditional IRA, the assets are accumulated pre-tax, grow tax free, and are taxed at ordinary income rates in retirement. In a ROTH IRA, the assets are accumulated after-tax, grow tax free, and are withdrawn tax-free in retirement. So, if a person can use their losses in excess of their insurance reimbursements to offset the tax consequences of converting traditional IRA assets to ROTH IRA assets, they may be able to save hundreds of thousands of dollars in taxes and drastically improve the tax efficiency of their retirement income for the rest of their lives.

*Contributions to a traditional IRA may be tax deductible in the contribution year, with current income tax due at withdrawal. Withdrawals prior to age 59 ½ may result in a 10% IRS penalty tax in addition to current income tax.

- Work with a qualified professional. There is care that needs to be taken if you are considering this strategy. Timing is important and I absolutely recommend you seek the counsel of a tax professional. If we can be of help to you, we would gladly work alongside your tax preparer to consider this strategy. If you need a recommendation for a tax preparer, we can provide a referral. Tax planning is a core element of our service at Higgins and Schmidt Wealth Strategies, however we are not tax preparers. We believe working as a team with partner professionals is in the best interest of our clients and I hope we are able to help you make the most of what has been a very challenging situation. Federally declared disasters are not common and there is little in the way expertise on the matter in our community. Please be thoughtful when considering advice.

Next Steps.

I encourage you to explore whether you can benefit from this strategy. Too many people are missing out on a major aspect of federal assistance provide for by the declaration of a federal disaster.

I welcome you to join me for a brief phone call or virtual meeting by reaching out to our client service associate, Alexis Miley at alexis@hswscolorado.com or 720.287.0918.

We hope the information we provide leads to improved outcomes and if it’s appropriate, we would appreciate the opportunity to be of service. We look forward to meeting you.

If you would like us to reach out to provide more information, please provide your contact information and we will be in contact soon.

Find a pdf version of this post here.

Securities offered through LPL Financial, Member FINRA/SIPC. Investment advice offered through Higgins & Schmidt Wealth Strategies, a registered investment advisor and separate entity from LPL Financial.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification and asset allocation does not ensure a profit or protect against a loss. Stock investing involves risk including loss of principal. Bonds are subject to market and interest rate risk if sold prior to maturity.

Bond values will decline as interest rates rise and bonds are subject to availability and change in price. Rebalancing a portfolio may cause investors to incur tax liabilities and/or transaction costs and does not assure a profit or protect against a loss. Contributions to a traditional IRA may be tax deductible in the contribution year, with current income tax due at withdrawal. Withdrawals prior to age 59 ½ may result in a 10% IRS penalty tax in addition to current income tax.