Climbing the Wall of Worry

Market in Recovery. Can It Be Trusted?

By: Steven Higgins, Financial Advisor, Principal

The last year has been a sort of haunted house for investors as every corner turned has revealed ghastly horror eliciting an to urge react, scream, or run from the not-so-fun house all together. The seemingly constant barrage of fear and the length of the current bear market (now entering its 18th month*) have the potential to wither once stalwart investing disciplines. In an effort to make the pain stop or at least harness a moment to breathe, long-term investors may be tempted to use the latest or next apparent “crisis” as an off-ramp with an expectation that they will resume their investing and financial planning journey when things start to look better. However, history tells us there’s serious risk in waiting for a calmer sea and bluer sky. The reality is: markets recover well before the economics, as has been the case over the last year. By nature, markets look forward in anticipation of future outcomes, and economic data tells you what happened in the past. Therefore, using daily, weekly, monthly, and quarterly data headlining your preferred business news channel will tempt you to stare into the rearview mirror as you careen forward down the financial highway. I suggest you keep your eyes on the road ahead.

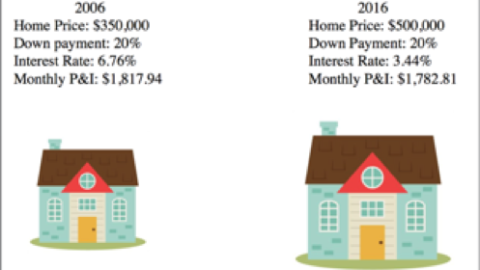

In June of 2022, we saw an annual inflation figure of 9.1%, the highest in four decades. The Federal Reserve had already raised its benchmark overnight rate several times as Fed Chair, Jerome Powell emerged from the Jackson Hole summit meeting to deliver a dire and direct message: there were to be significant and aggressive interest rate increases ahead. The Federal Reserve increased interests rates to tighten money supply and slow down an overheating economy. The stock market, as well as the bond market, were roiled. On October 12, 2022 the S&P 500, a broad measure of U.S. Stocks, bottomed down 25% from the all-time high set on New Year’s Eve 2021. Since October we have seen a characteristic market recovery as cracks in the economy continue to show and widen as a result to the Fed’s efforts to contain inflation. Since October, the Fed has increased the Fed Funds rate from 3.25% to 5.25% with expectations of a few smaller hikes still possible. In March, we witnessed the demise of several significant banking institutions and classic “bank runs” leading the government to save the day by guaranteeing customer deposits while the “big banks” moved quickly to shore up the system. Reports of layoffs and pay freezes have been rampant, especially in the technology sectors. Home prices have cooled off as mortgage rates near 7% have diminished purchasing power. The war in Ukraine has sadly persisted, and China has struggled to re-open from its long economic COVD hibernation. Latest on the list, was the woefully disgraceful debt ceiling fiasco in Washington D.C. as policy makers played political roulette with our country’s economy and economic standing in the world. And, as we awake to another morning, the sun risen, our feet finding the ground, we can once again confirm: the flag is still there.

So, how do we reconcile the significant recovery in stock markets with all of the fear? Can we trust it? The stock market, as a forward looking pricing mechanism, is not so concerned about what is happening today and is not concerned at all with happened yesterday. The market is constantly trying to price in what is going to happen six, twelve, eighteen months from now. So the fact that we were witnessing increasing inflation a year ago caused the market to correct in anticipation of the Fed increasing interest rates, that’s why the market bottomed well in advance of the Fed indicating the rate and size of the rate increases would be smaller. Now, a year later we see significant decreases in the rate of inflation. In June of 2022 the inflation rate peaked at 9.1% as of April, we now see a rate of inflation at 4.9%. With the weighty inflation figures from May and June of last year falling off the annual figure, it highly possible that we see a rate of inflation in the high threes to low fours in the very near future. With inflation on retreat the Fed has every reason to slow the rate of increases and even consider stopping the rate hikes all together.

Remember, it was the anticipation of aggressive rate hikes in response to inflation that caused the stock market to react by dropping as much as 25% in the S&P 500 and 35% in the technology heavy NASDAQ Composite (ycharts.com). With most if not all of the Fed rate hikes behind us the market assumes the worst of the economic tightening is over. We do know however the monetary policy such as rate increase have a lagging effect on the economy and can take up to a year to have an effect. So it’s thought that economic reactions and cracks in the economy are likely to persist for a while and will possibly if not likely result in a recession. So if a recession or at the least, a recessionary environment is seemingly a forgone conclusion if the opinion of pretty much every economist is correct then why is the market in recovery with the shoe about to drop? The answer….because it is expected. The bond markets are and have been telling us a recession is imminent. History also tells us that periods of significant Fed interest rate hikes pretty much always end with recession. Again, so aren’t we running for the hills? The concept of defining recession was created by what is now called the National Bureau of Economic Research (NBER), a non-profit made up of economists and professors. These people are academics, not politicians or bureaucrats. The NBER examines business cycles and by their own definition do not use consistent or stated sets of data to determine if and when we are or “were” in a recession. The bureau does not forecast what will happen in the future they tell us when a recession started and when a recession ended. All this to say, whether we were or are in a recession will be old news when we find out so it’s of less concern to the stock market.

As noted in past articles, stock market performance has an interesting relationship with recessions. It makes sense: the concept of a recession isn’t related to stock prices. However, the presence of or the fear of a recession seems to be an emotional motivator for many investors therefore the market performance and recessions are related, but not by blood. To our clients I apologize because I am about to beat you over the head with these figures again. But, I love this chart and I will continue to tell the world. Since 1945 we have experienced 13 recessions. They average 10 months in length. Most periods of recession correlate to gains in the stock market as measured by the S&P 500 and the average stock market gain through the recession has been 5.45%. Most notably, in the year following a recession, stocks gained over 21% with 12 of 13 years being positive by double digits. Now, jumping off the chart is the 2008/2009 recession, wherein we saw stocks drop by 25% during the recession amidst a total drop in stocks by 55%. The 2008 recession was really bad in a multitude of ways and stocks took a long time to recover. Even so, the S&P 500 with dividends included is up over 741% since the March 9, 2009 market low.

Recessions are no fun, especially if you are one of the people who get laid off as increasing unemployment coincides with periods defined as recessions. However, we do have to stay conscious of plans, objectives, and goals. Nerves are raw and there will continue to be monsters under the bed and in the closets. If you really think about it, from an investor’s perspective, has there ever really been a time when there wasn’t anything to be scared of? It’s a really big world and there are whole lot of people and organizations that benefit from keeping you scared of what is around the next corner. A long-term investment strategy in concert with a financial plan must include a plan to manage market volatility, not avoid it. There must be thought given to short term liquidity needs within the next five years. Emotional reactions and speculation can be extremely detrimental to a long-term plan as the decision to abandon a thought out process must then be met with a decision to re-employ a process and the chances of both of these decisions being repeatedly correct is not likely.

Nobody said this would always be fun and easy. Amassing significant wealth and being a steward of that wealth takes process and discipline. Sure, there are a lot of companies and agents willing to take the fear and discipline off your hands for a cost. Promises are made at the expense of your opportunity. Bull Markets, Bear Markets, and Recessions are and will be a repeated pattern. They don’t stop because we retire, because we now have more money, or because we just decided to start paying attention. This is what investing feels like. It’s hard, it’s normal, and that’s okay.

* As of 6.9.23, the market officially entered bull territory, up 20% from the lows in October 2022 (LPL Research, Bloomberg)

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.