Inflation: It’s Baaack!

Event Recap

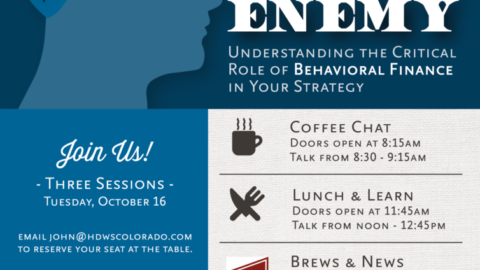

Thanks for joining us at our Lunch & Learn and Brews & News events. We wanted to recap a couple key concepts and also address a couple questions we received.

Key concepts:

- Past and current political policies have combined to create an environment poised for higher than average inflation in the future.

- We believe the next significant move for interest rates will have to be up since we’re close to record lows at under 3% on the 10-year US Treasury. Bond prices and interest rates are on a teeter-totter, when interest rates rise, bond prices fall.

- From an investment management perspective, we are positioning portfolios for rising rates and increased inflation by reducing our fixed income positions and allocating to other assets that are less interest rate sensitive and non-correlative to the stock market.

- Historically times of increased inflation have coincided with a significant increase in stock market volatility.

What about deflation?

Deflation has not been a meaningful part of the economic narrative. It’s more of an academic discussion than a historical

lesson in the United States. Deflation is similar to a unicorn, many people can describe a unicorn and even draw a picture, but have never actually seen one.

If baby boomers have driven the economic train for the last 60 years, what happens as they retire and become less economically productive? The only generation

larger than the baby boomers is the Millennial generation. Millennials on average have arrived to the economic game later than previous generations, however, a

re hitting their stride entering the household formation phase.

Household formation is the most economically impactful time in a person’s life, buying homes, consistently earning more, and ultimately spending more.

If not bonds, then what? We certainly don’t recommend eliminating fixed income completely, bonds are a pillar in a portfolio. However, we do recommend overall reducing the maturity of bond investments and complimenting them with other assets that are less sensitivity to increases in interest rates and provide some non-correlation to the stock market. We believe there is significant downside risk in long-term bonds.

Thanks again for joining us!

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. The opinions expressed in this material do not necessarily reflect the views of LPL Financial. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful. All investing involves risk including loss of principal. Bonds are subject to market and interest rate risk if sold prior to maturity. Bonds are subject to availability and change in price.