Here are a couple of the common questions that were asked at our “Brews & News: Tax Strategies” Brews & News: Hungry for Information Series.

1) Can I convert just part of my Traditional IRA balances to a Roth IRA?

Yes, you can choose to convert as much or as little as you want of your eligible balances in IRAs. This flexibility enables you to manage the tax cost of your conversion.

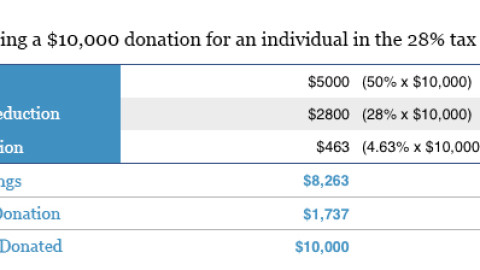

As we discussed at our Brews & News event, the pre-tax amount you convert is considered taxable income, you may want to consider converting no more than what you think will bring you to the top of your current federal income tax bracket. You also may want to consider basing your conversion amount on the tax liability you may incur so you can pay it without using money from your conversion.

2) Are there limitations (income, balance, timing) on Roth Conversions?

Income: Thanks to changes in 2010, there is no Modified Adjusted Gross Income or taxing filing limitations on Roth Conversions, aka you can make as much or as little and still do a Roth Conversion.

Balance: You can convert an unlimited number of dollars to a Roth IRA. Items to consider: Ability to pay the tax due on the conversion with funds outside of your IRA, and your current/future tax bracket.

Timing: You have until December 31st to complete the conversion in any given year.

As always, be sure to consult with your tax adviser.

3) How do I build diversified taxable sources of income in retirement?

1. Divert some contributions to a Roth retirement plan (if eligible).

2. Do a Roth conversion with a portion of traditional IRA assets.

3. Save regularly in a taxable account (i.e. single, joint, trust) buying traditional assets such as stocks, bonds, and mutual funds.

4) What is the significance of having a diversified income stream in retirement?

Here is a refresher from our presentation. Remember, Investor A and Investor B are exactly the same, except for one key difference – the diversification of their income sources in retirement. This diversification allows for Investor B to have more control over their tax status, due to their single account and their tax-free income from their Roth IRA. This strategic planning leads to Investor B having a portfolio that is worth over $1 million more than Investor A’s at the end of their life.

The information has been obtained from sources considered to be reliable, but we do not guarantee that the foregoing material is accurate or complete. You should discuss any tax or legal matters with the appropriate professional. Any information is not a complete summary or statement of all available data necessary for making an investment decision and does not constitute a recommendation. This information is provided only as an illustration. There is no guarantee these results will be met. Past performance is no guarantee of future results.