Competition Competition, as in many professional arenas, is remarkably fierce in the financial services sector. Two types of advisors have...

Archive for category: All

Steve Higgins Tell us a little bit about yourself. I’m a proud Broomfield native. I grew up here and...

Meet The Founders: Allie (DeYoung) Schmidt Tell us a little bit about yourself. Growing up I always thought I’d be...

Then comes the baby in the baby carriage… Written by: Allie DeYoung, Financial Advisor, CFP®, CPA Exciting! You’ve started...

Dive Deeper into HD Wealth Strategies In addition to our website, we maintain a presence on many popular social...

Think Strategically: Diversification is Mission Critical

Steven Higgins, Financial Advisor, Principal, , AllThink Strategically: Diversification is Mission Critical Diversification is crucial in not only what types of investments you own but...

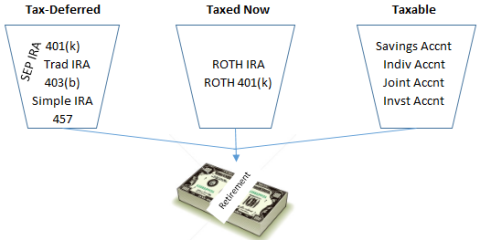

Bracketology & Buckets: Tips to Keep Yourself in a Lower Tax Bracket Over Time. By: Allie Schmidt, Financial Advisor, CFP®,...

Information to Help Keep Yourself in a Lower Tax Bracket Over Time In the spirit of the the upcoming...

Kicking Off Bike MS 2016 By Steven Higgins, Financial Advisor, Principal HD Wealth Strategies is proud to announce...

Video Blogs from HD Wealth Strategies By Steven Higgins, Financial Advisor, Principal You’ll get to see more of us...

Donate to the Cause

Higgins & Schmidt

Wealth Strategies

Recent Posts

Categories

Disclaimer Corner

Securities offered through LPL Financial, Member FINRA/SIPC. Investment advice offered through Higgins & Schmidt Wealth Strategies, a registered investment advisor and separate entity from LPL Financial. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification and asset allocation does not ensure a profit or protect against a loss. Stock investing involves risk including loss of principal. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price. Rebalancing a portfolio may cause investors to incur tax liabilities and/or transaction costs and does not assure a profit or protect against a loss.