Colorado PERA Pension in the COVID 19 Era By: Steven Higgins, Financial Advisor, Principal Colorado Public Employees’ Retirement Association...

Your investments at HD Wealth Strategies in 2020:

Allison Schmidt, Financial Advisor, CFP ®, CPA, , AllYour Investments at HD Wealth Strategies in 2020: Last Week Brought Rebalance #5 of the Year. By: Allie Schmidt,...

Stock Market Shines In the Face of the Storm Math Versus Fear By Steven Higgins, Financial Advisor, Principal We...

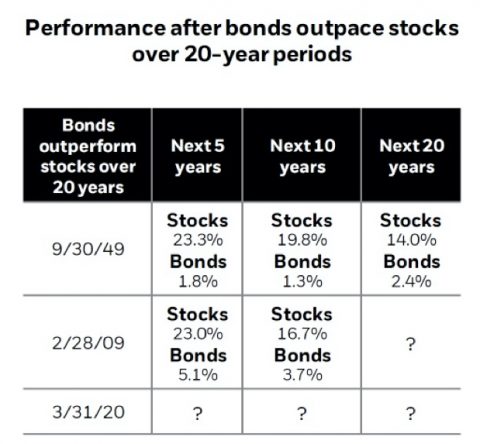

3 Historic Opportunities in the Midst of the Current Crisis

Allison Schmidt, Financial Advisor, CFP ®, CPA, , All3 Historic Opportunities in the Midst of the Current Crisis By: Allie Schmidt, Financial Advisor, CFP®, CPA

COVID-19: What’s Next? Moving Forward With a Plan and a Process “First was the sprint, now we’re in the...

Coronavirus Resources March 2020 will leave an imprint on our collective memories. The medical, social, and economic impacts of the...

Virtual Town Hall: COVID 19 economy. recovery. outlook.

Steven Higgins, Financial Advisor, Principal, , AllVirtual Town Hall: COVID 19 economy. recovery. outlook. We are all working through the barrage of information about COVID...

Tactical Financial Planning and Tax Management

Allison Schmidt, Financial Advisor, CFP ®, CPA, , AllTactical Financial Planning & Tax Management Market Volatility – What to do right now. Tax Loss Harvesting & Roth...

Perspective. Process. Poise. By: Steven Higgins, Financial Advisor, Principal & Allie Schmidt, Financial Advisor, CFP®, CPA Just 1 month ago,...

Working Remotely at Full Capacity A Message From Allie and Steve Due to the spread of the coronavirus and...

Donate to the Cause

Higgins & Schmidt

Wealth Strategies

Recent Posts

Categories

Disclaimer Corner

Securities offered through LPL Financial, Member FINRA/SIPC. Investment advice offered through Higgins & Schmidt Wealth Strategies, a registered investment advisor and separate entity from LPL Financial. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification and asset allocation does not ensure a profit or protect against a loss. Stock investing involves risk including loss of principal. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price. Rebalancing a portfolio may cause investors to incur tax liabilities and/or transaction costs and does not assure a profit or protect against a loss.