Sweet Emotion When The Markets Get Shaky, Do You? By Steven Higgins, Financial Advisor Volatility Risk & Investment Gain...

Touchstone Market Update: What You Need to Know for Q4 2015

Steven Higgins, Financial Advisor, Principal, , AllTouchstone Market Update: What You Need to Know for the Fourth Quarter of 2015 By Steven Higgins, Financial Advisor...

The Times They Are A-Changing… Congress Ends Social Security File-And-Suspend.

Allison Schmidt, Financial Advisor, CFP ®, CPA, , AllThe Times They Are A-Changing… Congress Ends Social Security File-And-Suspend. By: Allie Schmidt, Financial Advisor, CFP ®, CPA Since...

Greece Is the Word “We would never advise people invest simply because Greece is strong and we would certainly...

Can Increasing Interest Rates Cause Local Home Prices To Go Even Higher?…And my apologies to Kansas.

Steven Higgins, Financial Advisor, Principal, , AllCan Increasing Interest Rates Cause Local Home Prices To Go Even Higher?…And my apologies to Kansas. Turn on the...

Brews & News: Tax Strategies Event Follow-up

Allison Schmidt, Financial Advisor, CFP ®, CPA, , All, EventsHere are a couple of the common questions that were asked at our “Brews & News: Tax Strategies” Brews...

The Colorado Child Care Tax Credit: What You Need to Know

Molly Cooper, Compliance & Operations Manager, , AllThe Colorado Child Care Tax Credit: What You Need to Know Let’s be real: no one likes paying the...

Lunch & Learn: Social Security Series Follow Up

Allison Schmidt, Financial Advisor, CFP ®, CPA, , All, EventsHere are a couple of the common questions that were asked at our “Social Security: What’s Your Strategy?” Lunch...

Thanksgiving I love Thanksgiving for a lot of reasons. The actual day is wonderful. This year, I’ll be with...

Higgins & DeYoung kicks off Lunch & Learn: Hungry for Information Series

Allison Schmidt, Financial Advisor, CFP ®, CPA, , All, EventsAt Higgins & DeYoung, we strive to provide you with timely and relevant information on a consistent basis. In...

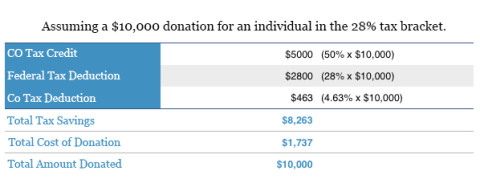

Donate to the Cause

Higgins & Schmidt

Wealth Strategies

Recent Posts

Categories

Disclaimer Corner

Securities offered through LPL Financial, Member FINRA/SIPC. Investment advice offered through Higgins & Schmidt Wealth Strategies, a registered investment advisor and separate entity from LPL Financial. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification and asset allocation does not ensure a profit or protect against a loss. Stock investing involves risk including loss of principal. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price. Rebalancing a portfolio may cause investors to incur tax liabilities and/or transaction costs and does not assure a profit or protect against a loss.