Post-Election 2016 Message There were many sleepy eyes venturing out to witness the sunrise this morning that some people...

Author Archive for: shiggins

Q3 2016 Market Update By Steven Higgins, Financial Advisor, Principal What A Difference A Year Makes The third quarter...

The Broomfield Rotary Club: Post Presidency

Steven Higgins, Financial Advisor, Principal, , CommunityPost Presidency By Steven Higgins, Financial Advisor, Principal I spent the last 12 months serving as president for the...

Live Long, Live Healthy Does Your Healthy Lifestyle Pose Additional Risks to Your Financial Plan? By Steven Higgins, Financial...

A 21st Century Tool for a 21st Century Retirement

Steven Higgins, Financial Advisor, Principal, , AllA 21st Century Tool for a 21st Century Retirement By: Steven Higgins, Financial Advisor, Principal Traditionally, the bread and...

Rising Mortgage Rates May Cause Home Prices to Go Even Higher

Steven Higgins, Financial Advisor, Principal, , AllRising Mortgage Rates May Cause Home Prices to Go Even Higher By: Steven Higgins, Financial Advisor, Principal Turn on...

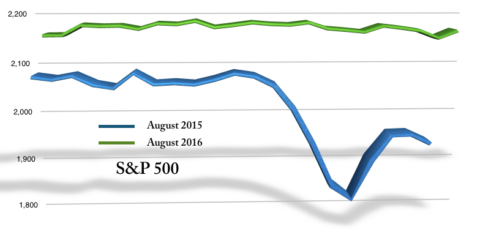

U.S. Stocks 2016 was a horrible start for stocks. By early February, stock indexes had already posted losses of...

Think Strategically: Diversification is Mission Critical

Steven Higgins, Financial Advisor, Principal, , AllThink Strategically: Diversification is Mission Critical Diversification is crucial in not only what types of investments you own but...

Information to Help Keep Yourself in a Lower Tax Bracket Over Time In the spirit of the the upcoming...

Kicking Off Bike MS 2016 By Steven Higgins, Financial Advisor, Principal HD Wealth Strategies is proud to announce...

Donate to the Cause

Higgins & Schmidt

Wealth Strategies

Recent Posts

Categories

Disclaimer Corner

Securities offered through LPL Financial, Member FINRA/SIPC. Investment advice offered through Higgins & Schmidt Wealth Strategies, a registered investment advisor and separate entity from LPL Financial. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification and asset allocation does not ensure a profit or protect against a loss. Stock investing involves risk including loss of principal. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price. Rebalancing a portfolio may cause investors to incur tax liabilities and/or transaction costs and does not assure a profit or protect against a loss.