Casual Finance Friday: Scared? Don’t Swerve

Written By: Steven Higgins, Financial Advisor, Registered Principal

Thanks for checking out the 5th edition of Casual Finance Friday! The whole point of this series is to send you into the weekend with some light-hearted info—or at the very least, give you a reason to point and laugh at me as I attempt to (and probably fail) to become the next great YouTube finance sensation.

My partner, Allison Schmidt and I have passion for sharing meaning advice about personal finance for those people with goals and aspirations as well as the means and dedication to achieve those both. If that’s you, we promise to serve you in a way that respects the sacrifices you’ve made and honor the legacy your resources represent. Above all we commit to keeping the promises we make and keeping your best interest at the forefront of the advice we give.

Now, I know, fear doesn’t sound fun. It feels like a heavy, dark, emotional topic. But I’m not here to talk about what scares you. I want to explore how fear can mess with your financial decision-making—and why it’s so important to acknowledge it if you want to reach your goals.

It’s often said that love, fear, and greed are the three most powerful emotions. And while love and greed pack a punch, I’d argue they’re no match for fear. Think about it, your hopes and dreams aren’t what wake you up at 2 a.m. Fear is. It’s the thing that feeds anxiety and steals sleep.

Ironically, our goals—things like security, health, longevity, and family—are usually reasonable and well within reach. But our fears? Not so much. They tend to be rooted in low-probability events: unlikely catastrophes that feel terrifying but aren’t very likely to happen. Of course, every good financial plan should account for risk and the possibility of curveballs—job loss, illness, market corrections, even the loss of a loved one. But even these events are usually manageable from a financial perspective with the right planning.

So if we’re honest about the role fear plays in our financial lives, we can learn how to acknowledge it and move through it without letting it drive the bus.

All the classic elements of financial planning matter: Goal setting. Investment management. Tax planning. Income strategies. But, I’d argue that learning how to process fear might be the most important piece. It’s the reactive, short-term decision-making that so often derails an otherwise thoughtful, well-designed plan.

You can have all the knowledge and tools in the world—but if you swerve when you know you shouldn’t, you might create a bigger problem. You’ve probably heard this driving advice before: If a squirrel runs in front of your car… don’t swerve. Just hit the squirrel.

Slam the brakes, and you risk getting rear-ended. Swerve, and you might hit a tree.

And still… we swerve, don’t we? Even though we know better. Why do we do it? Because it’s instinctual.

The right side of your brain is responsible for quick, reactive decision-making. That includes fear, intuition, and gut responses. The left side, on the other hand, is where logic, reasoning, and long-term planning live. Fear floods your system with adrenaline and cortisol and triggers your fight-or-flight response—designed to help you survive immediate danger. But it’s terrible at thinking about your future self. If your left brain doesn’t have the tools, knowledge, or confidence to speak up—because let’s face it, we’re not born with a built-in personal finance knowledge—your right brain takes over. And it starts spinning stories. It sees patterns where none exist. It connects dots that aren’t related. It builds a narrative designed to do one thing: make the discomfort stop.

That’s how people end up selling an investment—or an entire portfolio—during market volatility, even though the portfolio was built to weather exactly that kind of storm.

Disciplined planning and a solid investment process? Still undefeated. When your right brain says, “This time is different,” it might be imagining something that’s never happened before.

It doesn’t mean it can’t happen—it just means it probably won’t.

Nobody has a crystal ball. I certainly don’t. As financial advisors, we work with probabilities, not predictions. We help clients plan for what is most likely to happen. The data says you’re probably going to live longer than you expected. That’s great news—except when it comes to inflation and longevity risk. Those two factors, combined with repeated short-term, fear-based decisions, can seriously derail your ability to meet your financial goals.

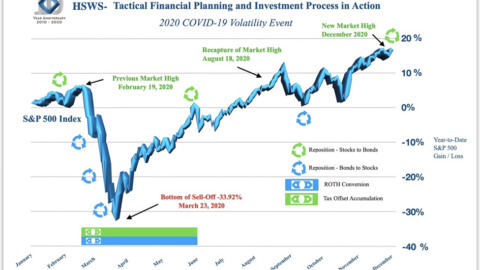

At Higgins & Schmidt Wealth Strategies, we talk openly and often with our clients about their fears and emotional reactions to money. We help clients build Personal Investment Policies, essentially giving the left brain a tool to push back when the right brain starts to freak out.

If your financial advisor isn’t having these conversations with you… honestly, you should probably get a new advisor.

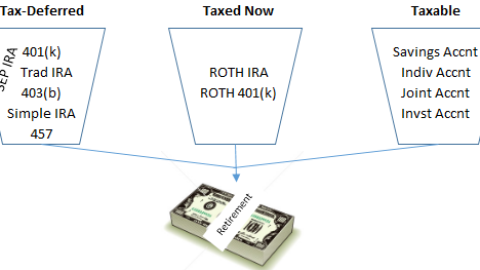

My partner Allison Schmidt, CPA, CFP, and I, along with our colleague Molly Cooper, work with an incredible team to deliver a concierge-level wealth management experience, with a emphasis on tax efficiency. We’re passionate about helping people understand this stuff—and most importantly, reach their goals.

If you have a question, an idea for an episode, or if you want to know more about what we do, check us out at hswscolorado.com or shoot me an email anytime: steven@hswscolorado.com.

Happy Friday!

Securities offered through LPL Financial, Member FINRA/SIPC. Investment advice offered through Higgins & Schmidt Wealth Strategies, a registered investment advisor and separate entity from LPL Financial.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. Roth IRA offers tax deferral on any earnings in the account. Qualified withdrawals of earnings from the account are tax-free. Withdrawals of earnings prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax. Limitations and restrictions may apply.

This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax advisor.

No strategy ensures success or protects against loss.