A Big Win for the Best of Us

The Social Security Fairness Act Restores Social Security Benefits for 2 Million Public Workers

By: Steven Higgins Financial Advisor, Registered Principal

Here’s a common-sense story out of Washington, D.C. Yes, you read that correctly. The Social Security Fairness Act(HR 82), addressing the Windfall Elimination Provision (WEP) and the Government Pension Offset (GPO), met little opposition and carried broad bipartisan support. Sponsored by Representative Garret Graves (R) of Louisiana, the bill was signed into law by President Joe Biden on January 5, 2025.

Since the 1970s, Social Security beneficiaries who also received pensions from jobs not covered by Social Security saw their benefits reduced. The WEP reduced benefits for individuals who had earned and paid into both Social Security and a pension. The GPO reduced survivor benefits for widows and widowers who would have otherwise been entitled to Social Security. In 2022, 3.1% of all Social Security beneficiaries were affected—amounting to 2 million retired teachers, firefighters, police officers, and other civil servants.

Whatever math justified this policy 50 years ago doesn’t pass the “smell test” today because it is terrible policy. These individuals rightfully earned both their pension and Social Security benefits—they paid into both systems separately. This was never a case of “double-dipping.”

With the passing of this law, beneficiaries are now entitled not only to an increase in their Social Security benefits but also back pay dating to January 1, 2024. While the exact timing of these payments is still unclear, the Social Security Administration (SSA) states that the rollout has begun and that all payments should be completed by the end of March. Back payments will reportedly be deposited into the same accounts where beneficiaries currently receive their benefits.

How Much Will Beneficiaries Receive?

The increase in benefits will vary significantly. Some will see an additional $100 per month, while others could receive over $1,000 per month, depending on their pension amount and earned Social Security benefits.

There are online calculators that estimate the impact of the WEP and GPO on Social Security benefits, but they often require detailed wage history data that most people don’t have. However, many affected individuals already have an idea of how much their benefit was reduced, which gives them a reasonable estimate of their expected increase and back pay.

Why This Matters

This is a big deal for millions of retired public servants who could really use the money—money that should have been theirs all along.

For many of our clients, pensions such as Colorado PERA (Public Employees’ Retirement Association) are key components of their retirement strategy. This increase in Social Security benefits will provide greater financial flexibility and strength in their retirement income plans.

The WEP and GPO were complex and punitive policies, and while their repeal is great news, the implementation details remain somewhat unclear. For now, the best advice is to monitor your bank account for the back payment and the increase in your monthly benefit.

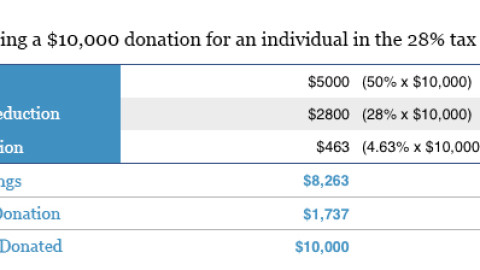

Also, keep in mind: Social Security benefits are taxable. If your back payment and increase are significant, you may want to adjust your quarterly tax payments to avoid an unexpected tax bill next year.

At Higgins & Schmidt Wealth Strategies, we provide an elevated wealth management experience for our clients.

With a focus on tax efficiency, we serve our clients in investments, financial planning, and retirement income strategies. Our team approach addresses the complexities that arise with higher levels of investable assets and diverse financial resources. Pension income and Social Security benefits should be strategically incorporated into your financial plan.

If you’d like to discuss how these changes may impact your retirement income strategy, we encourage you to reach out.

Resources:

- Social Security Administration FAQ on the Social Security Fairness Act

- Colorado PERA’s Response to the Act

Securities offered through LPL Financial, Member FINRA/SIPC. Investment advice offered through Higgins & Schmidt Wealth Strategies, a registered investment advisor and separate entity from LPL Financial.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification and asset allocation does not ensure a profit or protect against a loss. Stock investing involves risk including loss of principal. Bonds are subject to market and interest rate risk if sold prior to maturity.

Bond values will decline as interest rates rise and bonds are subject to availability and change in price. Rebalancing a portfolio may cause investors to incur tax liabilities and/or transaction costs and does not assure a profit or protect against a loss. Contributions to a traditional IRA may be tax deductible in the contribution year, with current income tax due at withdrawal. Withdrawals prior to age 59 ½ _may result in a 10% IRS penalty tax in addition to current income tax.