Bringing 2024 to a Close:

Milestones, Markets, and Strategic Partnerships

Written by: Allison Schmidt, Financial Advisor, CFP®, CPA

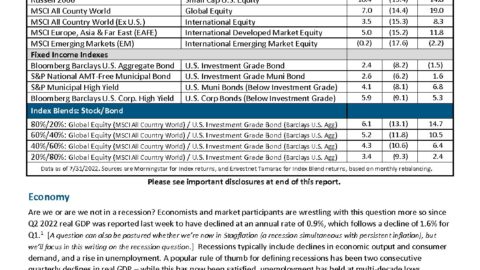

Quite a year 2024 has been. Caitlin Clark achieved the milestone of becoming the all-time leading scorer in NCAA basketball, Mexico elected its first female president, Claudia Sheinbaum, and Donald Trump became the first Republican since George W. Bush in 2004 to win the popular vote. Additionally, the S&P 500 is set to increase by double-digits this calendar year, an outcome few analysts predicted. For further insights, make sure to check out Steve’s next article Deconstructing the Crystal Ball, where he digs into annual forecasting and market predictions

The market’s strength has been bolstered by a robust economic backdrop, easing inflation pressures, and the commencement of a Federal Reserve rate-cutting cycle.

As part of our investment strategy, we have actively refined our client portfolios throughout the year to leverage market movement and opportunities. This will culminate in a year-end rebalance to ensure that our portfolios are appropriately positioned for 2025. We remain dedicated to consistently monitoring and assessing the economic and market landscape to construct portfolios that align with our clients’ specific goals and expectations.

In our ongoing efforts to enhance our investment process for our clients, we are pleased to announce our partnership with Eric Stein and East Bay Investments. Eric and his team will assist us in our investment due diligence, research, and portfolio analysis. Their support aligns with our shared investment philosophy of emphasizing strategic allocations and maintaining reasonably low-cost and tax-efficient investments.

Over the past several months, Steve and I have engaged extensively with Eric to discuss, analyze, and review our portfolios in light of current conditions. During the upcoming rebalance, you may notice minor adjustments in your portfolios reflecting the prevailing economic environment.

As many of you may recall, our investment process consists of two main components: tactical opportunities, our portfolio rebalance process based on the S&P 500, and economic realities, where we assess the current market and economic environment to position portfolios accordingly.

An example of an identified economic reality is the valuation of smaller companies. This has led us to slightly increase exposure to these stocks deemed undervalued with higher profitability potential. This will be a discussion theme in our upcoming client meetings as well.

Please be assured that Steve and I will continue to make all portfolio decisions, and East Bay does not have access to client names, account information, or any other client-specific data.

Eric and his team at East Bay are here to support our efforts. Steve and I value their insights and contributions thus far. By working with East Bay to assist with investment research and analysis, we can put our focus where it matters most: working directly with clients to create personalized strategies. We take our responsibility to you, our clients, very seriously and believe that this partnership will add value.

A little more background on Eric…Eric Stein, a Chartered Financial Analyst (CFA), brings with him years of experience in the investment field. He will be assisted in this role by his East Bay partner, Mario Nardone, CFA.

Stein has extensive investment experience developed through the variety of roles held during his career, including serving as Vice President at Goldman Sachs Asset Management, where he earned his Chartered Financial Analyst (CFA) designation in 2001. He also served as the Chief Investment Officer for RSM U.S. Wealth Management for over ten years, providing strategic leadership and solutions for their national investment platform. Before joining East Bay in 2018, he worked with global investment manager Nuveen, where he was focused on business intelligence and strategy. Stein is based in Charlotte, N.C.

Nardone has deep experience in investment management beginning in 1999 at Vanguard. He earned his Chartered Financial Analyst (CFA) designation in 2003, thereafter transitioning to Chief Investment Officer and Chief Compliance Officer for a financial planning and advisor firm. In 2010, he launched East Bay Investment Solutions in Charleston, S.C.

We want to take this opportunity to wish you and your family a very happy holiday season and prosperous new year. We look forward to working with you in 2025!

Eric Stein, Mario Nardone, and East Bay Investments are not affiliated with Higgins & Schmidt Wealth Strategies or LPL Financial.