Are Retirees Too Conservative With Their Investments Once They Get Into Retirement?

Written by: Allie Schmidt, Financial Advisor, CFP®, CPA

Retirement is changing, it is no longer defined as a move from your desk chair to your rocking chair on the porch to gently rock your way through the next couple golden years. Retirees are active…they want to travel, play golf, hike, run around with their grandkids, etc. Today’s retirement is now more commonly defined in terms of decades than in terms of a handful of years.* So, if retirement timeframes and spending habits are changing, should retirement portfolios change as well? After all, overly conservative investments can be just as risky as overly aggressive ones…both scenarios could produce the same possible outcome…outliving your money.

As is true with anything in financial planning or life for that matter, it depends on your situation, but the overarching thought that moving into retirement means moving all assets to bonds and CDs doesn’t make sense any more. People are living longer, and living just flat out costs more. Assets and income not only need to last for another 20 years or so, but really need to increase to keep up with those increasing costs.

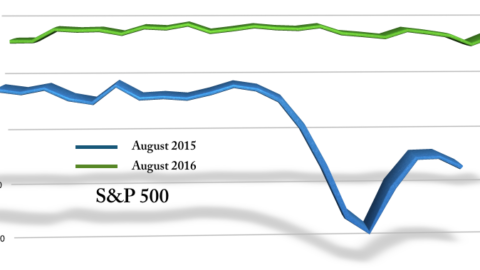

It’s important to invest in a way that will make that possible, which is where withdrawal rate on a portfolio is hugely important. Let’s say you withdraw about 3.5% from your portfolio on an annual basis, throw in inflation of about 2.5% on average, and we need a return of right around 6% to allow that income to not only be consistently available but also keep up with inflation. In today’s interest rate environment, a significant overweight to bonds or CDs won’t get you there. There will need to be some stock or equity exposure to create that type of average return, which as you know, will also create negative volatility from time to time. This type of negative volatility we refer to as “the investor’s compromise”. Typically you can multiply your annual return expectation over time by about 5-6 to see what your potential maximum downside at one point in time is. For example, an average return of about 6%, would create a portfolio that in the “Great Recession” of 2008-2009 likely went down between 30%-36% at the low. This doesn’t work every time, but is a good general idea of how a portfolio could move. This could be painful. “On average, a person feels the pain of financial losses twice as much as they feel the ecstasy from gains,” says Barbara Reinhard, head of asset allocation at Voya Investment Management. For retirees, this disparity is even higher: “When you’re a retiree, it’s not 2-to-1 that you feel the pain; it’s 5-to-1.” I’m not sure how that can be measured exactly, but I think she makes a fair point. In general, investors tend to be more focused on avoiding a loss than they do maximizing the growth of their investments and this tends to be true across all age groups.

So, what do you do? There’s another piece to the puzzle of not outliving your money in retirement, and that’s your expenses. If you know that you don’t have the risk appetite to take on a portfolio that could have that type of volatility, it’s important to recognize or “know thy self” and not take on that type of portfolio. At the end of the day in that scenario, something does have to give, and withdrawal on the portfolio likely needs to be reduced. As financial advisors, we make a very conscious effort of having these types of positive and negative “worst case scenario” type conversations from the very beginning to try to put people into portfolios that support their plan and also they will be able to stay invested. One of my favorite analogies is that stock investing is just like riding a rollercoaster, they’re both completely safe so long as you don’t hop off in the middle. Silly and very basic, but couldn’t be more accurate. All in all, we think that selling at the wrong time is the event most likely to cause the failure of a retirement strategy, so making sure people are invested in portfolios they can stick to is profoundly important.

*Average retirement in the US lasts about 18 years, according to data from the U.S. Census Bureau.

Securities offered through LPL Financial, Member FINRA/SIPC. Investment Advice offered through HD Wealth Strategies, a registered investment advisor and separate entity from LPL Financial.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.